Bitcoin and Portfolio Allocation: Insights from BlackRock's Research

In this post, I deep dive into BlackRock's research article on Bitcoin's returns, strong positive skewness, and implications for allocating Bitcoin to investment portfolios. Could this be the paper that set off the ETF gold rush?

The 2022 study "Asset Allocation with Crypto: Application of Preferences for Positive Skewness" explores Bitcoin's return distribution from 2010 to 2021, highlighting its extreme volatility (132% per year) and significant positive skewness. The study demonstrates that Bitcoin's skewed returns make it an attractive asset for different types of investors. These findings underscore the importance of understanding Bitcoin's unique characteristics for effective portfolio management and regulatory oversight.

The paper is not on the radar of academics (only 8 citations on Google Scholar as I write this in July 2024). Given the paper's implications for institutional Bitcoin adoption, I think it is a must-read. However, it is very much a technical math and modeling paper, which makes it hard to interpret.

So let's jump in and take a step-by-step approach that helps get at the intuition behind the formulas and numbers. Below, you will find:

- Study basics and links

- Who might be interested in this research, and why?

- A plain-English article overview, along with some potential implications

Study Information

Article Citation:

- Ang, A., Morris, T., Savi, R., 2022. Asset allocation with crypto: application of preferences for positive skewness. The Journal of Alternative Investments 25, 7-28. Available (open assess: https://doi.org/10.3905/jai.2023.1.185)

Keywords:

- Bitcoin returns

- Volatility

- Positive skewness

- Mixture of Normals distribution

- Bliss regime

- Asset allocation

- Power utility

- Cumulative Prospect Theory (CPT)

- Equity-bond portfolios

- Investment strategies

Key Assertions

Bitcoin's Return Distribution is Highly Volatile and Positively Skewed

- Volatility: Bitcoin exhibits extreme volatility, with an annualized rate of 132%, significantly higher than traditional assets like equities and bonds.

- Positive Skewness: The return distribution of Bitcoin is characterized by a significant positive skewness, with a third central moment of 1.44. This skewness indicates a tendency for extreme positive returns, making Bitcoin an attractive asset for investors seeking high-reward outcomes.

Optimal Portfolio Allocations Include Significant Bitcoin Exposure

- Constant Relative Risk Aversion (CRRA) investors: For investors using the CCRA utility framework, which focuses on mean-variance optimization, the study finds that optimal Bitcoin allocations can reach up to 85% in certain scenarios. This high allocation reflects the attractiveness of Bitcoin's potential returns despite its volatility.

- Cumulative Prospect Theory (CPT) Investors: For CPT investors, who overweight low-probability, high-reward outcomes, optimal Bitcoin allocations are around 3%, even with just a 0.06% probability of the "bliss regime" occurring, and up to 18% with when there is a 0.16% probability of the bliss regime.

Regulatory and Policy Considerations Must Reflect Bitcoin's Unique Characteristics

- Regulation: Policymakers and regulators need to understand Bitcoin's distinct risk-return profile to develop effective guidelines. The significant volatility and positive skewness imply that regulatory frameworks should balance the need for innovation and investor protection.

- Investment Strategies: The study's findings suggest that traditional investment strategies must adapt to incorporate Bitcoin, considering its potential for high returns and role as a hedge against economic instability.

Stakeholder Perspectives:

Who might be interested in these insights and why?

- Industry Leaders: For asset managers and portfolio strategists, BTC presents an innovative addition to enhance diversification and potential returns. The findings suggest that even with high volatility, BTC's positive skewness makes it a valuable asset.

- Policymakers and Regulators: Understanding BTC's risk-return profile is crucial for developing effective regulations. The significant volatility and skewness imply that regulatory frameworks must balance innovation with investor protection.

- Investors: Both institutional and individual investors must weigh BTC's high volatility and potential for extreme gains. The study provides insights into optimal allocations, guiding investment decisions based on risk preferences.

Article Overview

Bitcoin's Performance

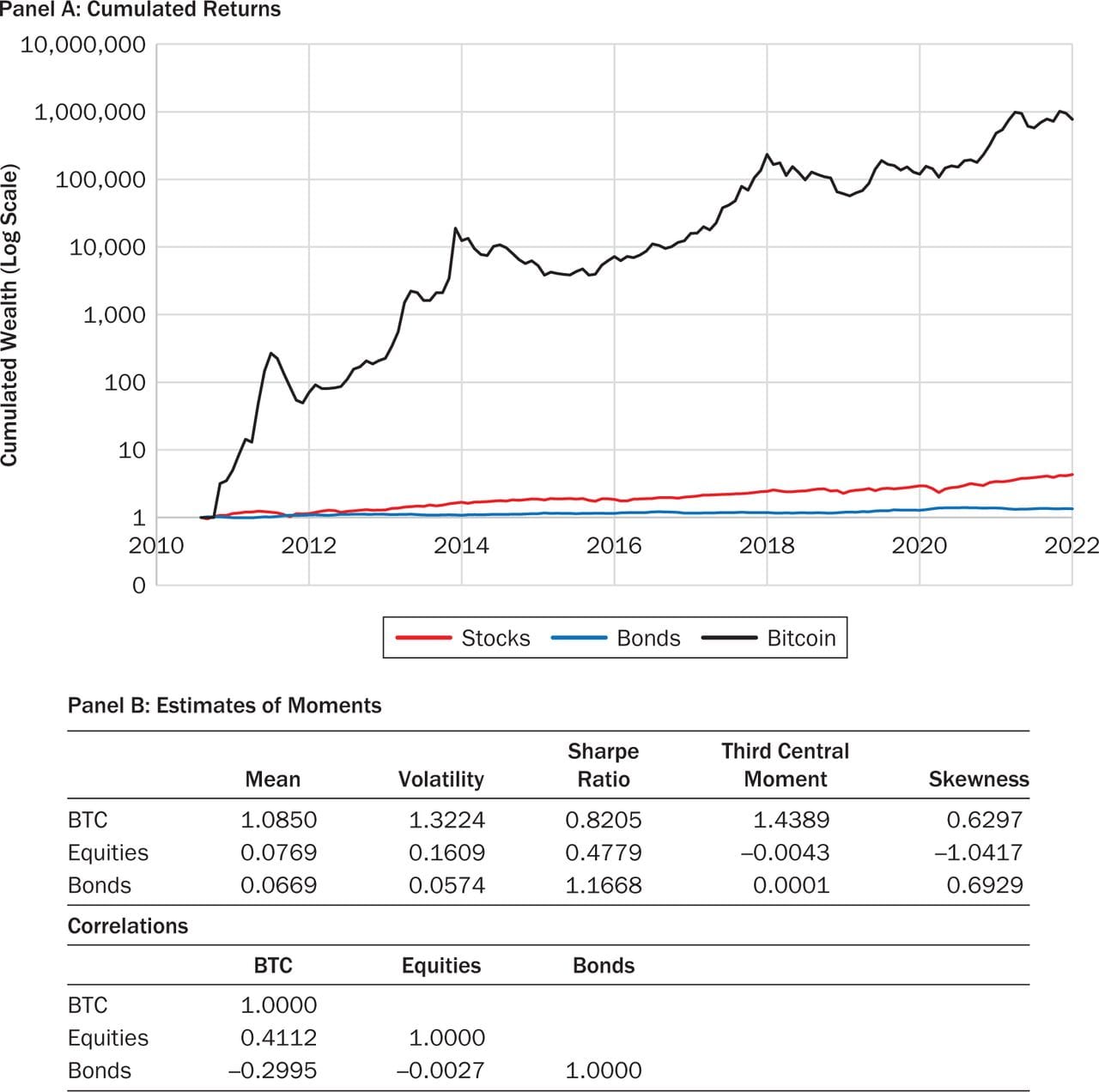

Bitcoin (BTC) has emerged as a significant asset in the financial world, known for its high returns and volatility. From July 2010 to December 2021, BTC exhibited an annualized volatility of 132%, significantly higher than traditional assets like equities and bonds. Additionally, BTC's return distribution is characterized by strong positive skewness, indicating the possibility of extreme positive returns. The chart and table below are from the article by BlackRock researchers, Andrew Ang, Tom Morris, and Raffaele Savi:

Quantifying the Distribution of the Returns

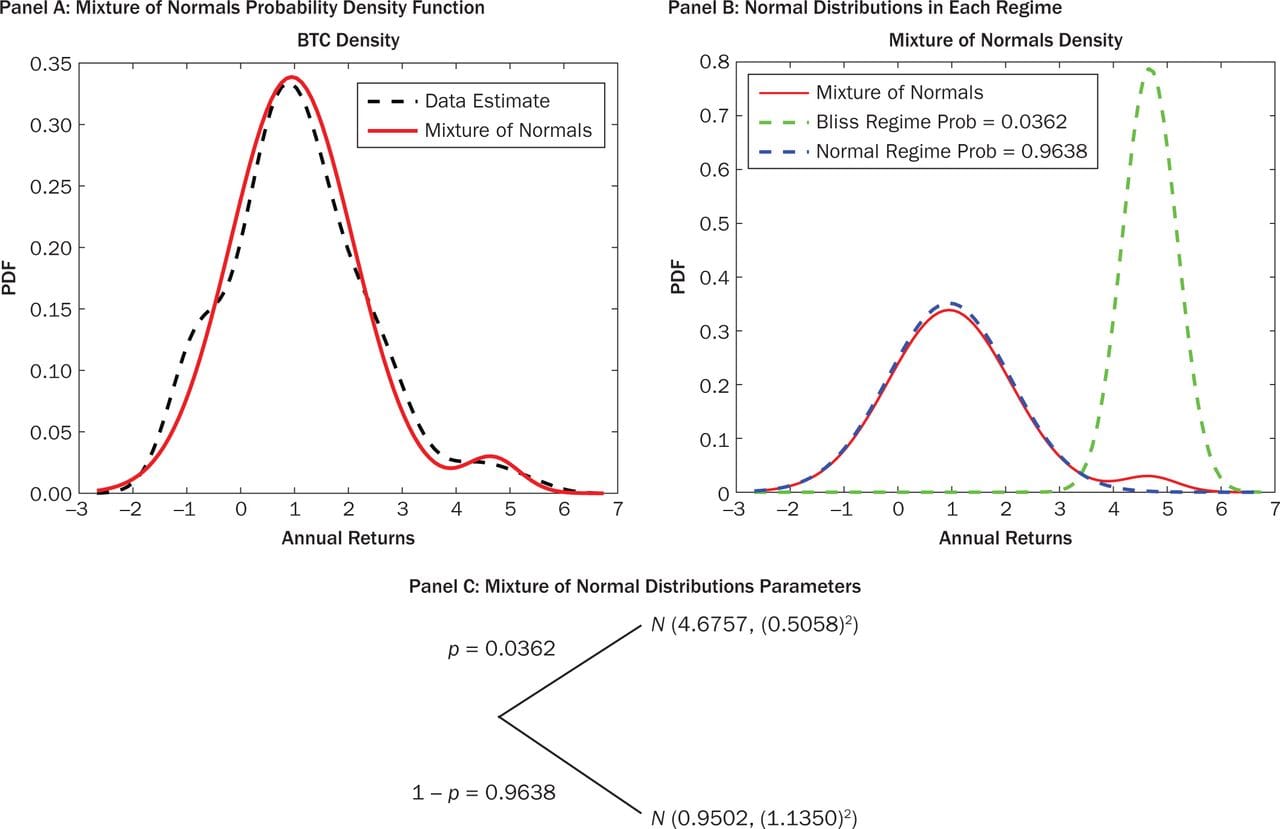

The study employs a 'mixture of normals' distribution to model BTC returns. In plain English, that means they identified two bell curves within the 2010-21 data. One, the normal zone, is where Bitcoin spent 96.4% of its time, and another, which they dubbed the "bliss regime," where it spent 3.6% of its time. Panel B, on the right, shows how the combination of the two normal distributions allowed them to emulate the overall distribution pattern, with the bumpy, fat upper tail in Panel A (left).

The high-probability normal zone had a mean return of 95% per year and the low-probability bliss regime had a mean return of 467% per year.

That kind of distribution has drawn the attention of investors with positive risk preferences - anyone seeking serious alpha. But, as the BlackRock researchers show, there are important implications even for risk averse investors.

After initially quantifying the nature of the bimodal Bitcoin return distribution, the researchers dug a little deeper, exploring how different types of investors, who hold different risk preferences, would optimally allocate Bitcoin into a traditional equity-bond portfolio.

Investor Utility Functions: CCRA preferences

If investors held Constant Relative Risk Aversion (CRRA) preferences, a fairly standard assumption for investors in portfolio allocation models, Bitcoin allocations could reach 3% when the chance of the bliss regime was 1.9%. Regarding Bitcoin allocations, the authors found that:

"2% or 3% allocation to BTC favored by Peterffy or Dalio can be justified by small probabilities of 0.005 or 0.019, respectively, of the bliss regime occurring."

Even if during the 96% of the time Bitcoin is in the normal regime it were to experience a 50% average price decline, the extremely high returns during the bliss regime imply Bitcoin allocations still would help diversify portfolios and enhance overall returns.

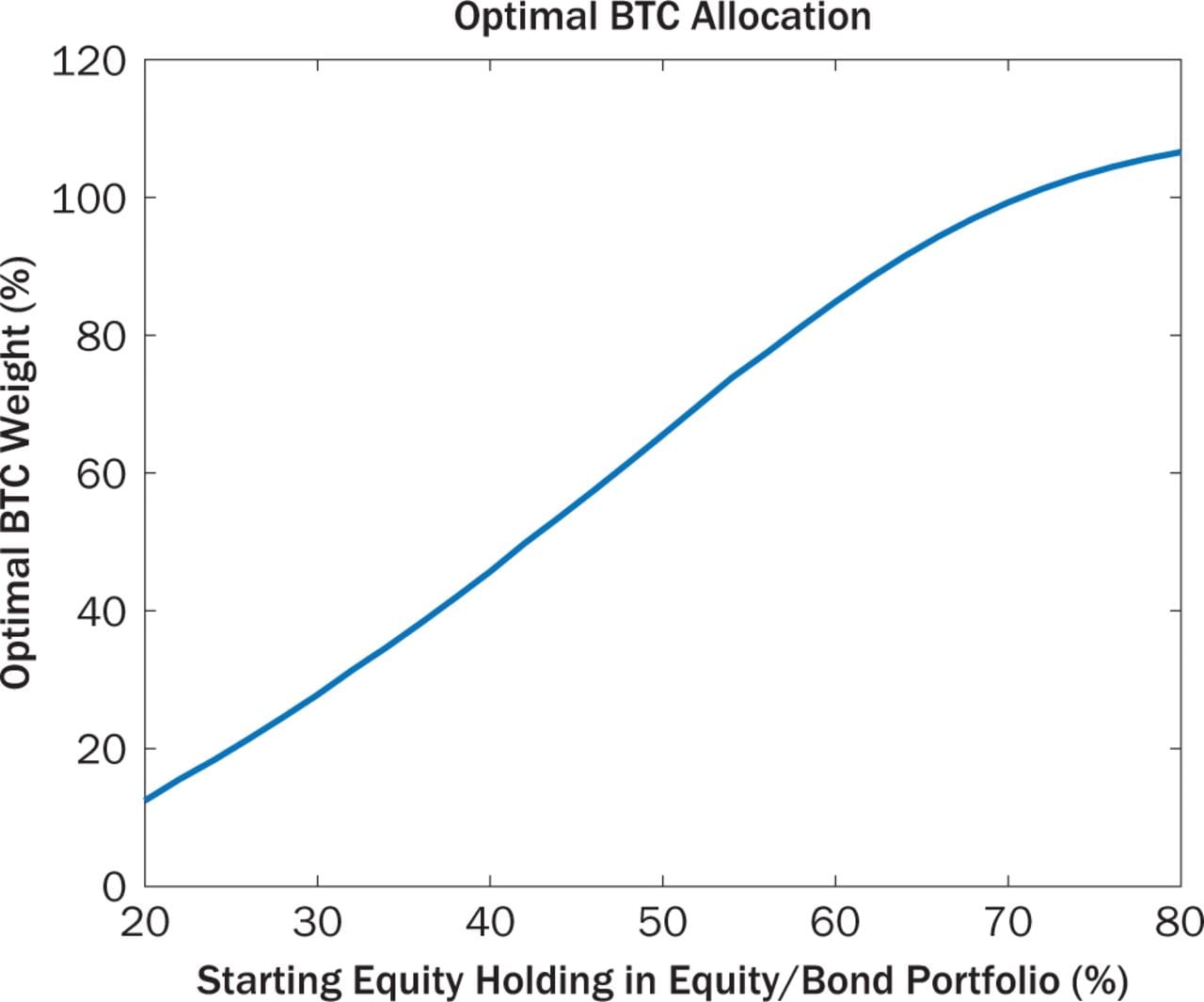

Optimal allocation can go very high, all the way up to 106% (leveraged long):

Starting at a 20–80 stock-bond portfolio leads to a 12.5% BTC allocation, and a risk tolerant investor with an 80–20 stock-bond portfolio desires a levered position in BTC of 106.6%.

The chart below shows the relationship the researchers quantified for the CCRA utility assumption. Risk parameters are used to construct the optimal equity-bond ratio for a portfolio in the CCRA model. Thus, the x-axis can be interpreted in terms of the level of risk aversion an investor exhibits. The farther to the left, the more risk averse an investor would be - still, a conservative 20/80 investor would optimally allocate 12.5% Bitcoin to their portfolio. The farther to the right on the x-axis, the less risk averse an investor - an aggressive 80/20 investor would go total degen, switching entirely to Bitcoin and add some leverage for good measure.

Investor Utility Functions: CPT preferences

Rather than a CRRA utility function, investors may instead hold loss aversion preferences, a characteristic of Cumulative Prospect Theory (CPT). CPT was developed by Amos Tversky and Daniel Kahneman (Kahneman, a Nobel economics laureate, will be familiar to many Bitcoiners as the author of Thinking Fast and Slow).

CPT investors exhibit loss aversion, "where investors are more sensitive to losses than they are to gains of the same magnitude." However, loss averse investors do not automatically choose investments that yield lower returns and are, in fact, extremely sensitive to upward skewness and extreme returns. Bliss regimes can be assigned very high weight in the utility function.

Even though agents are risk-averse over the large gain in the bliss regime, the payoff in the bliss regime is so large that an agent with CPT utility highly desires exposure to BTC right-tail skewness.

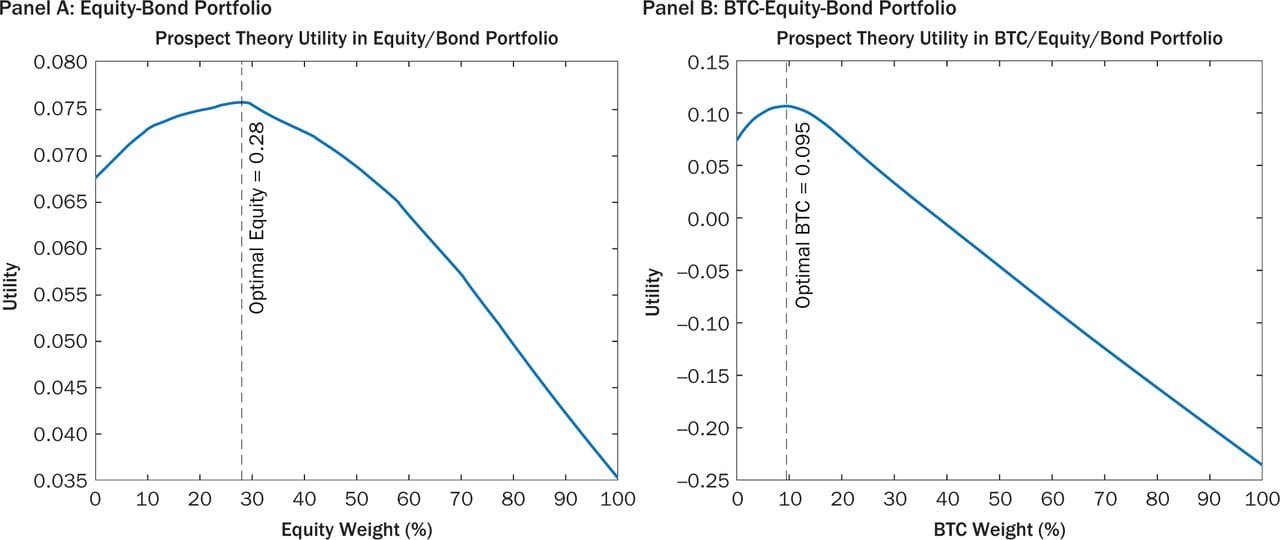

The BlackRock researchers looked first at a 28% equity share in a 2-asset equity-bond portfolio optimized under certain assumptions about the shape of the equity and bond return distributions (check the article for details). Then they assumed that the 28-72% mix would be held steady at the same ratio, but that Bitcoin would be added to the mix as a third asset. The optimal BTC allocation under CPT utility was 9.5% in this case, with the 28-72 equity-bond mix down to 91.5% of total holdings (figure below).

Initially, they used similar parameter assumptions in their model as for the prior CCRA utility function but that led to a situation where was a +∞ BTC allocation! After some model tweaks, to make it more conservative and get rid of the pesky positive infinity, they managed to get closed solutions. Still, even with the more conservative assumptions, only very tiny odds of reaching the bliss regime were needed for CPT investors to justify allocating Bitcoin to their portfolios. The numbers, you ask?

- Probability[bliss regime] = 0.05%: allocation = 1.3% BTC

- Probability[bliss regime] = 0.06%: allocation = 3.1% BTC

- Probability[bliss regime] = 0.16%: allocation = 17.8% BTC

...behavioral CPT investors are extremely sensitive to the right-hand skew of BTC returns. They allocate meaningful amounts of BTC to portfolios with probabilities in the range of five or six in a thousand of a bliss regime occurring, even with unconditionally negative BTC returns.

Caveats

It's extremely important to realize that the model's optimal allocations were extremely sensitive to small changes in investors' utility functions.

Additionally, this analysis only used data up to 2021, the end of the last Bitcoin bull market. Much has changed in the Bitcoin market since the 2021.

Real-World Impact

Remember, the authors of this paper are BlackRock researchers: their findings seem to have been taken seriously, at least in the finance industry if not in academia. Since the research was completed, BlackRock ramped up its Bitcoin purchases for its ETF to almost $21-billion and CEO, Larry Fink, has morphed into a strong Bitcoin advocate. What changed his mind?

Talking about Bitcoin during this July 15th interview, Larry Fink said:

As you know, I was a skeptic; I was a proud skeptic. And I studied it, learned about it, and I came away saying, okay, my opinion five years ago was wrong. This is what I believe in today. I believe in the opportunity today. I believe Bitcoin is […] a legitimate financial instrument that allows you to have maybe uncorrelated, non-correlated type of returns.

Consider the amount of internal vetting that this research article must have undergone prior to BlackRock approving its release. The article was published in Spring 2022; allowing for journal submission and review, that means BlackRock had likely finished their internal review and due diligence by mid-2021, near the top of previous Bitcoin bull market.

To me, that suggests that the numbers in this paper proved unassailable by internal critics.

If so, this article could well have been the research that initially led Larry Fink and other corporate leaders to pivot on Bitcoin, and to initiate the corporate push for Bitcoin ETFs in the USA.

Outlook

Bitcoin's extreme volatility and positive skewness will likely continue to attract investors seeking high returns despite the associated risks. As the Bitcoin market evolves, traditional asset managers will need to incorporate skewness preferences into portfolio optimization models.

The study's findings highlight the importance of understanding Bitcoin's risk-return profile for effective portfolio management and regulatory oversight. This perspective aligns with BlackRock's substantial investment in BTC, reflecting the real-world application of academic research in investment strategy.

Critique

There are two things to consider with this paper: the choice of investor utility functions; and the limitations inherent in the Bitcoin dataset.

Utility Functions

The choice of CRRA and CPT utility functions is appropriate for this type of modeling. The optimal allocation results are, however, extremely sensitive to parameterization. Very small changes in parameter values can have very large impacts on Bitcoin allocation strategies.

Models are representation of the world and are only as good as their build and assumptions. The question here is not whether the BlackRock researchers were correct or not to use these utility functions and parameters - they followed established modeling procedure - but more about whether Bitcoin is yet well enough understood to be modeled at all. Bitcoin's hard cap of 21-million coins puts in place an inelastic supply curve that is unlike any other asset humans have used as money. How best to model and forecast Bitcoin price dynamics over time with such an absolutely inelastic supply and diverse range of buyers, including national governments, is still very much an open question.

Bitcoin Dataset

The dataset the researchers used capture Bitcoin's price history until 2021. However, given Bitcoin is still in its infancy from an adoption perspective, it is uncertain as to how model parameterization might change over time, or whether other utility functions might prove more suitable for modeling Bitcoin investors' risk preferences.

While a potential shortcoming, with no obvious solution other than to wait it out until we have more data, this study also opens the door for ongoing follow-up research that refines model structure and parameterization over time.

Note that, as of 20 July 2024, this Ang et al. article only been cited 8 times to date (once by me), indicating it has not yet been widely recognized by other financial researchers in academia: https://scholar.google.com/citations?view_op=view_citation&hl=en&user=gP-PebcAAAAJ

Even with major institutional adoption of Bitcoin in the first half of 2024, it looks like we are very much still early.

The Journal and Authors

Journal

The Journal of Alternative Investments (JAI) is an academic journal focused on the evolving field of alternative investments. It provides detailed analysis and expert insights on non-traditional investments, including managed futures, commodities, hedge funds, private equity, and cryptocurrencies like Bitcoin. JAI aims to equip institutional portfolio managers with practical tools and proven risk management practices. It has seen growing citations, reflecting its influence in both academic and professional circles, but they do not list journal impact factor on their website.

Authors

Andrew Ang: Managing Director at BlackRock. Before joining BlackRock, Ang was a professor of finance at Columbia Business School, where he published extensively on topics related to asset management, portfolio selection, and risk management. Ang holds a PhD in finance from Stanford University. His research has been widely recognized, with >35,000 citations on Google Scholar:

Tom Morris: Tom Morris is also a Managing Director at BlackRock, based in London. His expertise includes asset allocation, risk management, and the development of innovative investment solutions. Morris has a degree in economics from the University of Cambridge and an MBA from INSEAD..

Raffaele Savi: Managing Director at BlackRock, based in San Francisco. He leads BlackRock’s Systematic Active Equity team, which focuses on applying quantitative models and big data analytics to equity investing. Savi's work involves developing strategies that leverage technology and data to drive investment decisions. He has degrees from the Polytechnic University of Milan and an MBA from the University of Chicago Booth School of Business

Comments ()