Bitcoin is full of surprises

Full article summary: Rudd, M.A., 2023. Bitcoin is full of surprises. Challenges 14, 27. In this article - my own from 2023 - I explore how a Pragmatist approach can bridge left-leaning progressive values with Bitcoin's diverse potential benefits, particularly in areas important to progressives.

Article Link

Bitcoin as a Catalyst for Environmental and Social Transformation

Summary

This briefing note explores the unexpected ways in which Bitcoin, a decentralized digital currency, intersects with left-leaning progressive values such as environmental sustainability, poverty alleviation, and human rights. The analysis reveals that Bitcoin has the potential to mitigate methane emissions, enhance the economics of renewable energy, and provide financial autonomy in repressive regimes. These findings suggest that Bitcoin could play a pivotal role in addressing global challenges, necessitating a nuanced and informed approach to its regulation and adoption.

Overview

Bitcoin, traditionally viewed through a lens of high energy consumption and association with libertarian ideals, holds surprising potential for contributing to environmental and social progress. This potential is often overlooked in mainstream discourse, where Bitcoin is criticized for its carbon footprint. However, when examined through a Pragmatist perspective, Bitcoin's ability to support renewable energy production and reduce methane emissions presents a compelling case for its environmental utility.

Moreover, Bitcoin's decentralized nature offers significant advantages for individuals living in repressive regimes. It provides a means of financial autonomy that is difficult for authoritarian governments to control, thus empowering individuals and supporting human rights. This capacity for financial privacy and independence has earned Bitcoin the moniker "freedom money" in many global contexts.

These findings challenge the conventional narrative that Bitcoin is solely a tool for speculation or illicit activity. Instead, Bitcoin emerges as a multifaceted innovation with the potential to bridge ideological divides and contribute positively to global challenges. The key lies in intelligent inquiry and the development of policies that harness Bitcoin's benefits while mitigating its risks.

Pragmatism: a Practical Philosophy for Navigating Uncertainty

Pragmatism is a philosophical approach that emphasizes the importance of experience, action, and the practical consequences of beliefs. Developed in the late 19th and early 20th centuries by American philosophers such as Charles Sanders Peirce, William James, and John Dewey, Pragmatism rejects the idea that knowledge is static or absolute. Instead, it argues that what we know and believe should be constantly tested and refined based on our experiences and the outcomes of our actions.

At its core, Pragmatism is about making decisions based on what works in practice. It suggests that ideas and theories are valuable not because they are inherently true, but because they help us navigate and make sense of the world. For Pragmatists, the truth of a belief is determined by its usefulness—if a belief helps us achieve our goals or solve problems, it is considered "true" in a practical sense.

Pragmatism is particularly relevant in the context of Bitcoin and emerging technologies because it encourages open-minded inquiry and adaptability. As Bitcoin challenges traditional financial systems and introduces new ways of thinking about money and value, a Pragmatist approach allows us to explore these innovations without being constrained by rigid ideologies. Instead of asking whether Bitcoin aligns with existing economic theories, Pragmatism prompts us to consider how Bitcoin might be used to address real-world challenges, such as financial inclusion or environmental sustainability.

Pragmatism may serve as a guiding principle for understanding the dynamic and evolving nature of Bitcoin. It encourages people to critically assess their assumptions, engage in continuous learning, and remain open to the possibility that Bitcoin—despite its controversies—may offer practical solutions to some of the world's most pressing problems. By adopting a Pragmatist mindset, we can better navigate the uncertainties of the digital economy and make informed decisions that are grounded in experience and practical outcomes.

Implications

The potential of Bitcoin to contribute to environmental and social progress carries significant implications for a range of stakeholders. For policymakers, this suggests the need for a balanced regulatory approach that fosters innovation while addressing concerns about energy consumption and market stability. Policymakers must consider how to leverage Bitcoin's ability to support renewable energy and reduce greenhouse gas emissions while ensuring that its growth does not exacerbate existing inequalities.

For environmentalists and renewable energy advocates, Bitcoin presents an opportunity to collaborate on initiatives that align Bitcoin mining with sustainable practices. Co-locating Bitcoin mining operations with renewable energy facilities could provide a constant revenue stream for these producers, enhancing the financial viability of clean energy projects. This could accelerate the transition to a low-carbon economy and contribute to global climate goals.

Future Outlook

Looking ahead, Bitcoin's role in the global economy is likely to expand as its potential benefits become more widely recognized. As research continues to explore the intersections between Bitcoin and environmental sustainability, there may be increased efforts to integrate Bitcoin into renewable energy strategies. This could lead to a more sustainable and resilient energy grid, with Bitcoin playing a key role in balancing supply and demand.

Moreover, as Bitcoin adoption grows in politically unstable regions, its impact on human rights and poverty alleviation could become more pronounced. The expansion of Bitcoin-based financial services could provide unbanked populations with new opportunities for saving and transacting securely, fostering greater economic inclusion. However, this growth will also require careful management to ensure that it does not introduce new risks or exacerbate existing inequalities.

Broader Implications for Bitcoin

Bitcoin and Environmental Sustainability

Bitcoin's potential to support environmental sustainability represents a significant shift in the narrative surrounding its energy consumption. By integrating Bitcoin mining with renewable energy sources, there is an opportunity to enhance the financial viability of these projects, thereby accelerating the global transition to a low-carbon economy. This integration could also promote innovation in energy storage and grid management, leading to more resilient and efficient energy systems. However, it is crucial to ensure that the energy used in Bitcoin mining is sourced sustainably to avoid exacerbating the environmental challenges it seeks to mitigate.

The Role of Bitcoin in Human Rights and Financial Inclusion

Bitcoin's decentralized and permissionless nature offers a unique tool for promoting financial autonomy and human rights, particularly in regions under repressive regimes. This capability can empower individuals by providing access to secure financial services without reliance on traditional banking systems, which are often inaccessible or controlled by authoritarian governments. The implications of this are far-reaching, as it could lead to greater economic inclusion and stability in regions where financial exclusion is a significant barrier to development. Nevertheless, the use of Bitcoin in such contexts must be carefully managed to avoid potential misuse and to ensure that it truly serves as a tool for empowerment.

Bitcoin's Impact on Global Economic Models

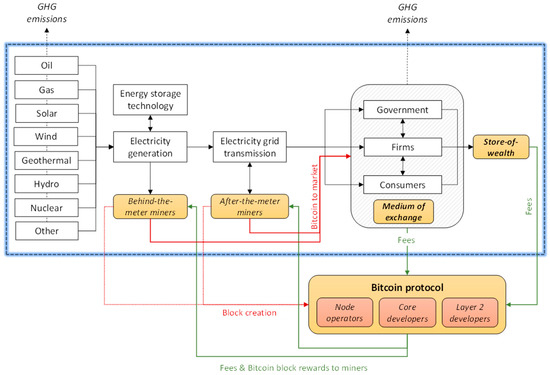

As Bitcoin continues to gain traction, it is likely to have broader implications for global economic models, particularly in the areas of monetary theory and financial markets. Bitcoin's role as a digital store of value and its potential to function as a medium of exchange could challenge traditional financial systems and monetary policies. This could lead to shifts in how value is stored and transferred globally, influencing everything from personal savings strategies to international trade dynamics. The challenge will be in managing these shifts to avoid destabilizing existing economic systems while leveraging Bitcoin's strengths to create more robust and inclusive financial models.

Policy and Governance Challenges

The adoption of Bitcoin introduces complex policy and governance challenges, particularly in balancing innovation with regulation. Governments will need to develop frameworks that not only address the risks associated with Bitcoin, such as energy consumption and market volatility, but also promote its positive contributions to society. This will require a good understanding of Bitcoin's potential impacts across different sectors and a willingness to engage with stakeholders from diverse backgrounds. Effective governance will be key to ensuring that Bitcoin's growth benefits the broader public while mitigating potential negative outcomes.

Technological Innovation and the Future of Bitcoin

The scalability of Bitcoin's infrastructure and its integration with emerging technologies will be critical to its future success. As adoption increases, Bitcoin's network will need to evolve to support higher transaction volumes and more diverse use cases, particularly in areas like renewable energy and human rights protection. This evolution will likely spur technological innovations that could further enhance Bitcoin's functionality and security. The development of Layer 2 solutions, like the Lightning Network, is just one example of how Bitcoin's infrastructure might adapt to meet future demands, ensuring that it remains a viable and valuable tool in the digital age.

Comments ()