Bitcoin’s Path to Global Accessibility

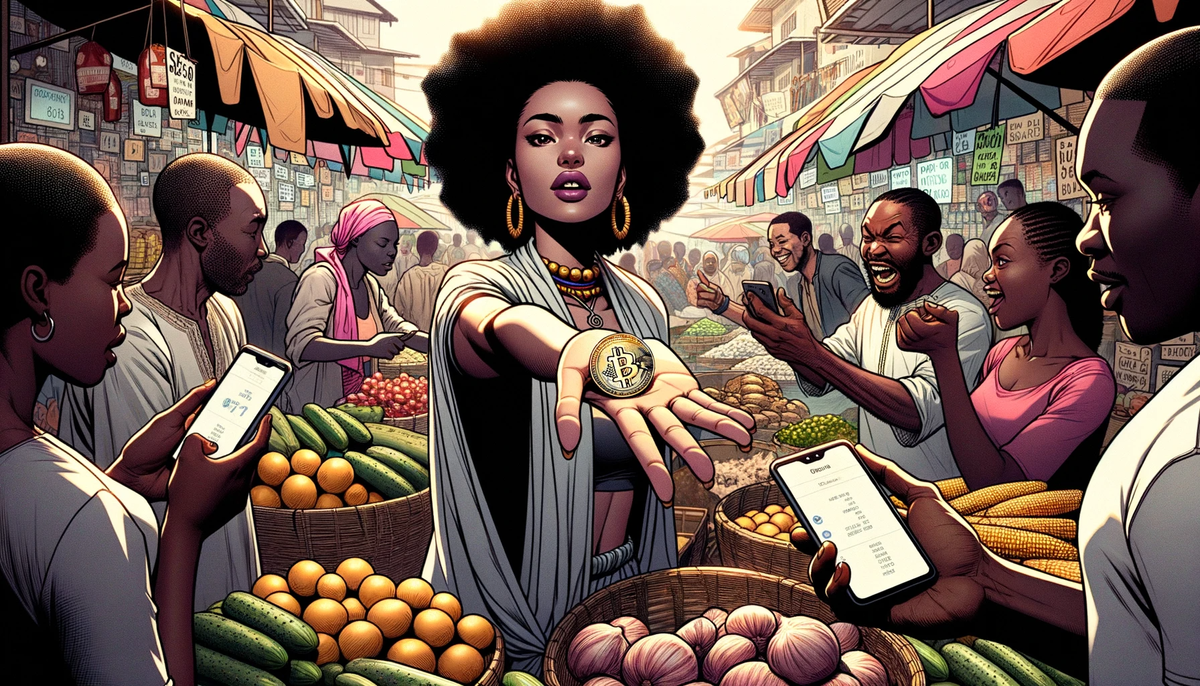

The September 6, 2024 episode of The Bitcoin Source featured Akin Fernandez, who explores the mission of Azteco, a Bitcoin voucher service designed to make Bitcoin accessible to everyone, especially those without traditional banking access.

Summary

The September 06, 2024 episode of the Bitcoin Source explores Akin Fernandez’s insights on Bitcoin’s role as a decentralized database and its potential to transform global financial inclusion through Azteco’s user-friendly Bitcoin voucher service. Fernandez emphasizes the importance of demystifying Bitcoin, advocating for its legal recognition as protected speech, and positioning it as a practical tool for everyday transactions, particularly among the unbanked.

Take-Home Messages

- Financial Inclusion through Bitcoin: Azteco’s voucher system aims to make Bitcoin accessible to the unbanked, providing a straightforward entry point into the global economy.

- Bitcoin as Protected Speech: Legal recognition of Bitcoin as a decentralized database rather than money could safeguard it from restrictive financial regulations, promoting wider adoption.

- Educational Efforts are Crucial: Demystifying Bitcoin and educating the public on its practical uses are essential for shifting perceptions and driving consumer adoption.

- Consolidating Bitcoin’s Position: The proliferation of altcoins creates market fragmentation; a focused effort to reinforce Bitcoin’s role as the primary digital asset is needed.

- Small Transactions, Big Impact: Emphasizing everyday Bitcoin transactions can transform it from a speculative asset into a widely used financial tool.

Overview

In an interview on The Bitcoin Source, Akin Fernandez, founder of Azteco, shared his vision for Bitcoin as a decentralized database with the potential to revolutionize financial inclusion. Fernandez’s approach through Azteco focuses on making Bitcoin as accessible as mobile phone top-ups, targeting populations that are typically excluded from traditional banking services. By offering Bitcoin vouchers, Azteco simplifies access to Bitcoin, enabling users to participate in the global economy without needing a bank account.

Fernandez stresses that Bitcoin should be understood not merely as money but as a technology—a decentralized, peer-to-peer database that facilitates financial transactions without the need for intermediaries. This perspective challenges conventional views and aligns Bitcoin with broader technological and social transformations. Fernandez advocates for the legal recognition of Bitcoin as protected speech under the U.S. First Amendment, arguing that this classification would prevent restrictive financial regulations that could hinder Bitcoin’s adoption and utility.

Fernandez’s insights also highlight the importance of educational efforts to shift public perception of Bitcoin. By moving away from narratives that position Bitcoin as an exclusive, speculative asset, and instead promoting it as a practical tool for everyday financial activities, stakeholders can drive more inclusive adoption. His examples from El Salvador, where Bitcoin is used for routine purchases, illustrate the potential for Bitcoin to integrate seamlessly into daily life when properly understood and implemented.

Looking ahead, Fernandez envisions a future where consumer Bitcoin adoption is prioritized, with small, frequent transactions becoming the norm. This shift could democratize Bitcoin’s use, making it accessible and relevant to individuals from all walks of life. Fernandez’s message is clear: Bitcoin’s success hinges on its ability to be seen as an everyday financial tool, rather than a complex investment vehicle.

Stakeholder Perspectives

- Consumers and the Unbanked: For individuals without access to traditional banking services, Azteco offers a straightforward way to engage with Bitcoin. This could significantly enhance financial inclusion, providing an alternative to conventional banking and a means to save, send, and spend money with ease.

- Regulators and Policymakers: Policymakers face a delicate balance between protecting consumers and fostering innovation. Fernandez’s advocacy for recognizing Bitcoin as protected speech may influence future regulatory approaches, potentially easing the pathway for broader Bitcoin adoption.

- Entrepreneurs and Developers: Fernandez’s call to focus on consumer Bitcoin solutions encourages developers to create accessible, user-friendly products. This approach can broaden the market for Bitcoin, attracting a diverse user base beyond the tech-savvy and early adopters.

- Financial Institutions: While Bitcoin challenges traditional banking models, it also presents new opportunities for financial institutions to integrate Bitcoin services, expanding their offerings and reaching untapped markets. Institutions that adapt to this shift could gain a competitive edge.

Implications

From a policy standpoint, the recognition of Bitcoin as a decentralized database rather than money could mitigate the risk of over-regulation, allowing the technology to flourish as a protected form of digital expression. This legal clarity would not only safeguard Bitcoin but also provide a more stable environment for businesses and consumers to engage with it.

For the industry, the emphasis on consumer Bitcoin adoption signals a shift towards more inclusive, user-friendly solutions that cater to everyday financial needs. Developers and entrepreneurs have the opportunity to innovate and create tools that simplify Bitcoin use, making it accessible to a broader audience. This could drive a significant transformation in how people perceive and interact with Bitcoin, moving it from the realm of speculative investments to practical financial utility.

On a societal level, Bitcoin’s potential to enhance financial inclusion by providing access to unbanked populations could reshape global financial systems. By offering a decentralized, inflation-resistant alternative to fiat currencies, Bitcoin presents an ethical and viable option for individuals seeking financial sovereignty. However, achieving this vision requires overcoming educational barriers and aligning legal frameworks to support Bitcoin’s unique position as both a technological and financial innovation.

Future Outlook

The future of Bitcoin, as outlined by Fernandez, lies in its ability to serve as a practical tool for everyday financial activities. As consumer adoption grows, driven by accessible solutions like Azteco’s Bitcoin vouchers, Bitcoin could become a mainstream financial option, rivaling traditional payment methods such as cash and credit cards. This transition would not only expand Bitcoin’s user base but also solidify its role as a key player in the global financial landscape.

Achieving this future will require ongoing advocacy and education to ensure that Bitcoin is recognized for what it truly is—a decentralized database with the power to enable financial transactions without intermediaries. Legal recognition as protected speech could play a crucial role in this process, shielding Bitcoin from burdensome regulations and fostering an environment where it can thrive. As Bitcoin continues to evolve, the focus must remain on making it accessible, practical, and relevant to users from all backgrounds, driving a fundamental change in how the world interacts with money.

Information Gaps

- Regulatory Classification of Bitcoin as a Database. Understanding how Bitcoin can be classified as a database rather than money is critical to protecting it from restrictive financial regulations. Current financial frameworks often do not account for the unique nature of decentralized digital assets, and without legal clarity, Bitcoin could face barriers that inhibit its broader adoption. Research in this area could pave the way for more favorable legal environments, enhancing Bitcoin’s growth potential and aligning it with First Amendment protections.

- Scalability Solutions for Consumer Bitcoin Adoption. As Bitcoin adoption grows, so does the need for scalable solutions that maintain low transaction costs and high security. Identifying technologies and approaches that address Bitcoin’s scalability challenges without compromising its core principles is vital. This research could significantly impact how Bitcoin is integrated into everyday financial transactions, making it a more practical choice for consumers worldwide.

- Effective Public Education Strategies on Bitcoin’s Utility. There is a significant need for comprehensive educational strategies that effectively convey Bitcoin’s true utility as more than just a digital asset. By addressing misconceptions and providing clear, accessible information, educational initiatives can help bridge the knowledge gap and drive adoption. This research could inform the development of targeted outreach programs that demystify Bitcoin and present it as a viable tool for financial inclusion and sovereignty.

- Impacts of Market Fragmentation on Bitcoin’s Position. Investigating how the presence of altcoins affects Bitcoin’s market position and user perception is crucial for developing strategies to consolidate Bitcoin’s dominance. As altcoins continue to emerge, they create a fragmented market that can confuse potential users. Research in this area would help identify pathways to strengthen Bitcoin’s role as the primary decentralized digital asset, fostering a more unified and accessible digital economy.

- Leveraging Ethical Finance to Promote Bitcoin Adoption. Bitcoin’s fixed supply and decentralized nature position it as an ethical alternative to fiat currencies, which are often criticized for inflationary practices. Research into how this ethical positioning can be leveraged to attract new users from traditional financial systems could be transformative. Understanding the motivators for users who value financial fairness could guide marketing strategies and product development, promoting Bitcoin as a solution to systemic financial inequities.

Broader Implications for Bitcoin

Bitcoin as a Tool for Financial Inclusion

Bitcoin’s ability to provide financial services to the unbanked presents a significant opportunity to drive global financial inclusion. By offering access through simple, user-friendly platforms like a voucher system, Bitcoin can enable millions of individuals without traditional bank accounts to participate in the global economy. This could help reduce financial inequality, particularly in developing regions where access to financial services is limited, and empower individuals with the ability to save, send, and receive money independently.

Legal Recognition and Protection

The push for Bitcoin to be legally recognized as a decentralized database rather than traditional money has far-reaching implications. Achieving this classification could protect Bitcoin from restrictive regulations that typically apply to financial institutions and currencies, thereby fostering a more open and innovative environment for Bitcoin-related businesses. This would not only accelerate adoption but also establish Bitcoin as a protected form of digital expression, aligning it with constitutional freedoms and potentially setting a global standard for digital asset regulation.

Consumer-Centric Bitcoin Adoption

The emphasis on consumer Bitcoin adoption highlights the shift from viewing Bitcoin as a speculative asset to seeing it as a practical tool for everyday transactions. This transition is crucial for mainstream acceptance, as it positions Bitcoin as a viable alternative to traditional payment methods like cash and credit cards. By focusing on small, frequent transactions, services like Azteco are poised to drive broader usage among everyday consumers, which could lead to a more decentralized and resilient financial ecosystem.

Navigating Market Fragmentation

The presence of numerous altcoins creates market fragmentation, which can confuse users and dilute Bitcoin’s market position. Addressing this challenge requires a concerted effort to consolidate Bitcoin’s role as the primary decentralized digital asset. By promoting Bitcoin’s unique advantages—such as its fixed supply, decentralized nature, and robust security—advocates can help guide users towards Bitcoin as the preferred choice. This unified approach could strengthen Bitcoin’s market dominance and simplify the digital asset landscape for new users.

Ethical Finance and Economic Empowerment

Bitcoin’s fixed supply and decentralized framework offer a stark contrast to the inflationary and often opaque practices of fiat currencies, positioning it as an ethical alternative in the financial world. This ethical positioning has the potential to attract users disillusioned with traditional finance and those seeking more transparent and fair financial systems. As Bitcoin continues to gain traction, its role as a tool for economic empowerment could reshape societal views on money, leading to a broader re-evaluation of how value is stored, transferred, and protected across the globe.

Comments ()