Challenging Bias in the ECB’s Bitcoin Analysis

Our paper critiques the recent working paper by Bindseil and Schaff (2024), which presents a negative assessment of Bitcoin’s long-term viability, framing it as a speculative asset with limited intrinsic value and significant risks.

Our paper below critiques the recent working paper by Bindseil and Schaff (2024), which presents a negative assessment of Bitcoin’s long-term viability, framing it as a speculative asset with limited intrinsic value and significant risks. The paper portrays Bitcoin’s volatility, lack of productive contribution, and wealth concentration as critical flaws, while positioning CBDCs as a superior solution for modern financial systems. In this critique, we explore Bindseil and Schaff’s core assertions, the methodological weaknesses in the working paper, and their framing of Bitcoin versus CBDCs.

Thanks to coauthors Allen Farrington, Freddie New, and Dennis Porter in helping to put this paper together! This was an initiative of Satoshi Action Education. Click the image below for a link to the full pdf.

Suggested citation:Rudd MA, Farrington A, New F, Porter D. 2024. Challenging bias in the ECB’s Bitcoin analysis. Working paper, Satoshi Action Education, Portland, Oregon. DOI: http://dx.doi.org/10.13140/RG.2.2.17555.28968

Introduction

Our paper critiques the recent working paper by Ulrich Bindseil and Jürgen Schaaf (2024), which presents a negative assessment of Bitcoin’s long-term viability, framing it as a speculative asset with limited intrinsic value and significant risks. Authored by European Central Bank (ECB) officials involved in developing Central Bank Digital Currencies (CBDCs), the paper portrays Bitcoin’s volatility, lack of productive contribution, and wealth concentration as critical flaws, while positioning CBDCs as a superior solution for modern financial systems.

The foundation of Bindseil and Schaff’s argument is that Bitcoin has shifted, from what they view as Satoshi Nakamoto’s (2008) vision for Bitcoin being a means of payment, to today’s focus on Bitcoin as an investment vehicle. This reflects Bindseil and Schaff’s misunderstanding or misrepresentation of Bitcoin’s evolution. This issue was central to the 2015-2017 “Blocksize Wars,” where a faction within the community sought to scale Bitcoin as a payment system by increasing block sizes, but the prevailing view—aligned with Satoshi Nakamoto’s original intent—prioritized decentralization and Bitcoin's role as a store of value (Bier, 2021). Satoshi himself highlighted Bitcoin's potential as a hedge against central banking policies, stating early on that “it might make sense to get some in case it catches on.”

Symbolic elements of Bitcoin’s creation, such as the reference to gold confiscation laws and the inclusion of “Chancellor on the Brink of Second Bailout for Banks” in the genesis block, further underscore Bitcoin’s foundation as a decentralized money rather than merely a payment system. Bindseil and Schaff misinterpret Nakamoto’s use of “cash” in the white paper’s title. “Cash” here refers to its bearer-asset nature, not just its payment utility or modality, as the authors assume. This fundamental misunderstanding pervades Bindseil and Schaff’s working paper.

Furthermore, the paper's surprisingly strong focus on U.S. politics—particularly the suggestion that Bitcoin could sway U.S. elections—raises concerns about the authors’ intent. Instead of providing a neutral academic analysis, the paper appears designed to influence public opinion beyond the ECB’s traditional jurisdiction. In this critique, we explore Bindseil and Schaff’s core assertions, the methodological weaknesses in the working paper, and their framing of Bitcoin versus CBDCs.

Assertions and their validity

Political lobbying by the crypto industry has a significant influence on policy and regulatory stances

Bindseil and Schaff argue that the cryptocurrency industry's lobbying exerts disproportionate influence, skewing regulatory policy in its favor and enabling speculative behavior that destabilizes financial markets. Their claim, however, conflates Bitcoin with the broader crypto industry. Bitcoin is a decentralized protocol, while the ‘crypto industry’ encompasses thousands of privately-developed blockchain projects, most of which are viewed as securities by regulators like the SEC.

Even in the crypto industry, lobbying efforts often seek regulatory clarity rather than an absence of oversight. As a democratic process used by all industries, lobbying in this context reflects the need for legal frameworks that accommodate a rapidly evolving technology.

Traditional financial institutions, such as banks, spend far more on lobbying than the nascent crypto sector, which in 2023 constituted less than 1% of financial sector lobbying expenditures in the USA. However, this dynamic has shifted in 2024, with crypto-related lobbying expenditures rising significantly ahead of the November 2024 election. This surge in spending is primarily driven by corporations such as Coinbase and Ripple, which represent broader crypto business interests, rather than Bitcoin-specific initiatives.

While Bitcoin may benefit indirectly from the increased crypto lobbying, it is important to note that Bitcoin-focused companies, particularly those without a commercial model like Bitcoin miners, lack the financial resources to contribute significantly to lobbying efforts. Bitcoin does not have a CEO, legal or marketing departments, or lobbyists: it is a neutral, global, leaderless protocol.

Bitcoin advocates typically operate without the institutional backing enjoyed by the corporations that dominate the crypto industry. Bitcoin mining, the sector most likely to afford lobbying, typically directs its budget internally, further limiting Bitcoin-specific political influence. Thus, framing Bitcoin lobbying as a unique threat is misleading and downplays the still dominant influence of traditional financial actors; Bindseil and Schaff overlook the far greater influence of entrenched financial actors and misrepresent the scale and nature of Bitcoin-related lobbying efforts.

Bitcoin ownership is highly concentrated among a small number of large players

Bindseil and Schaff (based on a working paper by Makarov and Schoar, 2022), argue that Bitcoin’s wealth is highly concentrated among a small number of holders, undermining its claims of decentralization. According to Bindseil and Schaff, this concentration presents risks of market manipulation and unfair redistribution of wealth.

This claim, however, overlooks the changing dynamics of Bitcoin ownership and the widespread dispersion of Bitcoin holdings. Institutional and retail investors have increased their level of participation in the market. For example, around 10% of Canadians owned Bitcoin by 2021 (Balutel et al., 2022) and in the UK, HMRC research showed that by 2021 about 10% of adults owned crypto assets, with Bitcoin being the predominant holding.

Miners receiving Bitcoin rewards can either hold or sell their rewards, with some firms retaining as much as possible after paying their operating expense and other firms selling all Bitcoin as they are mined. Overall, selling in the Bitcoin mining industry tends to be cyclical, with miners periodically draining their holdings to pay operating costs when the Bitcoin price is low, contributing further to Bitcoin’s wide distribution.

Many of the largest Bitcoin wallets belong to exchanges like Coinbase and Binance, and ETF issuers like BlackRock and Fidelity, who hold Bitcoin on behalf of millions of users. Recently BlackRock described how “80% of the buyers of these new spot bitcoin products in the U.S. are direct investors. Of the 80% of direct investors…, 75% had never before owned an iShare, one of the best-known and largest ETF providers on the planet.” Bindseil and Schaff create the appearance of concentration when, in reality, institutional and exchange wallets represent the holdings of diverse investors rather than single entities.

The suggestion that Bitcoin's wealth concentration is inherently unfair also raises concerns about the Bindseil and Schaff’s’ underlying worldview. They imply that any form of inequality is unjust, yet fail to explain why this applies—a free market for Bitcoin has been available to all since its inception. They (or anyone else) could have acquired Bitcoin at any point, both benefiting themselves and lessening the inequality they criticize. Presumably, however, they chose not to do so.

Unlike the vast majority of cryptocurrency tokens (‘altcoins’), Bitcoin had a fair and public launch. There was no pre-launch distribution of Bitcoin, no ‘founder shares,’ and no venture capital backers purchasing Bitcoin at a discount: everyone who accumulated Bitcoin had to undertake work to earn it (whether through mining or otherwise) or to pay market price when they purchased it.

The argument that concentration of wealth in Bitcoin is harmful reflects a misunderstanding of the Bitcoin protocol itself. Unlike traditional financial systems, large Bitcoin holders have no privileged position or influence over the network. The protocol rules apply uniformly to all participants, regardless of their holdings. This stands in stark contrast to fiat systems, where large financial players can exert disproportionate influence on monetary policy and market operations. In private corporations, even a significant minority shareholder can have significant influence over company decisions; such influence is not possible with Bitcoin. Bitcoin’s transparent nature (it is possible to track onchain transactions for individual wallets, e.g. https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html) allows for much clearer insights into ownership trends compared to traditional financial systems.

Bitcoin’s rising price creates positive consumption effects for holders but does not increase overall productivity or economic growth

Bindseil and Schaff claim that Bitcoin’s rising price disproportionately benefits holders without contributing to overall economic productivity or growth. They argue that the speculative nature of Bitcoin’s price creates wealth for early adopters and investors but fails to deliver meaningful contributions to the productive capacity of the economy. In their view, Bitcoin serves primarily as a mechanism for wealth transfer rather than a tool for fostering innovation or driving economic development.

This argument overlooks Bitcoin’s significant role in driving financial innovation and efficiency, particularly through its impact on decentralized finance and cross-border payments. Bitcoin functions as a technological protocol, similar to the TCP/IP protocol that underpins the Internet, enabling the development of new financial services. For instance, Bitcoin’s Lightning Network (Divakaruni and Zimmerman, 2023; Poon and Dryja, 2016) and other Layer 2 solutions reduce the need for traditional banking intermediaries, lowering transaction costs and improving economic efficiency. Strike’s app, for example, facilitates nearly cost-free, instant international remittance payments by converting Bitcoin into local fiat currencies for both the sending and receiving parties.

In developing regions, Bitcoin has proven particularly valuable in the remittance market, where high fees and slow processing times from traditional financial institutions have long been a barrier. Average global remittance fees are on average just under 8%, and can range as high as 20% (Kpodar and Imam, 2022). For countries that derive a large proportion of their GDP from remittances (remittances account for >22% of GDP in 10 poor countries highly reliant on remittance income: https://www.weforum.org/agenda/2023/01/chart-remittance-flows-impact-gdp-country/), slashing transaction costs could have dramatic impacts among the poorest households, who are traditionally excluded from banking services, and on the overall economy.

Moreover, Bitcoin is fostering innovation beyond payments. It has catalyzed advancements in cryptography and energy efficiency, particularly in mining technology. Bitcoin mining using waste landfill gas can mitigate methane emissions (Rudd et al., 2024), enhance the economics of variable renewable energy generation (Bastian-Pinto et al., 2021; Lal et al., 2023; Niaz et al., 2022), expanding production capacity, and contribute to grid flexibility due to Bitcoin mining’s unique demand-response characteristics (Carter et al., 2023; Fridgen et al., 2021).

Beyond these technological advancements, the argument against Bitcoin reflects a misunderstanding of the role money plays in capital accumulation and, by extension, economic prosperity. Productivity is driven by the accumulation of capital, and economic growth is the result of increasing productivity through the effective use of that capital. Coordinating complex economic activities across time and space requires money to mediate intersubjective value judgments. The more neutral the money, the more effectively these judgments can be coordinated, facilitating better capital allocation. Fiat money, subject to political manipulation, often results in inefficient capital allocation and economic distortion.

This is Bitcoin's core value proposition: that its adoption leads not only to increased productivity and economic growth, but also to fairer outcomes, in which those creating real value are rewarded, rather than those aligned with central banking policies. By offering a neutral, decentralized alternative, Bitcoin holds the potential to correct capital misallocation driven by fiat currency systems.

Bitcoin wealth leads to redistribution at the expense of non-holders and latecomers

Bindseil and Schaff argue that Bitcoin’s price appreciation results in wealth redistribution, benefiting early adopters at the expense of non-holders and those who enter the market later. According to them, Bitcoin operates as a zero-sum game where gains for early participants come at the cost of others, leading to a concentration of wealth in the hands of a few.

However, this argument disregards the voluntary nature of Bitcoin markets, where participants freely choose to enter based on their own assessment of the asset’s potential. Like early investors in stocks or venture capital, Bitcoin’s early adopters assumed significant risk in exchange for potentially high returns—an inherent feature of markets for emerging technologies. The price discovery process is driven by market forces, and the idea that latecomers are systematically disadvantaged overlooks the fact that Bitcoin is still in an early stage of adoption, with substantial room for future growth.

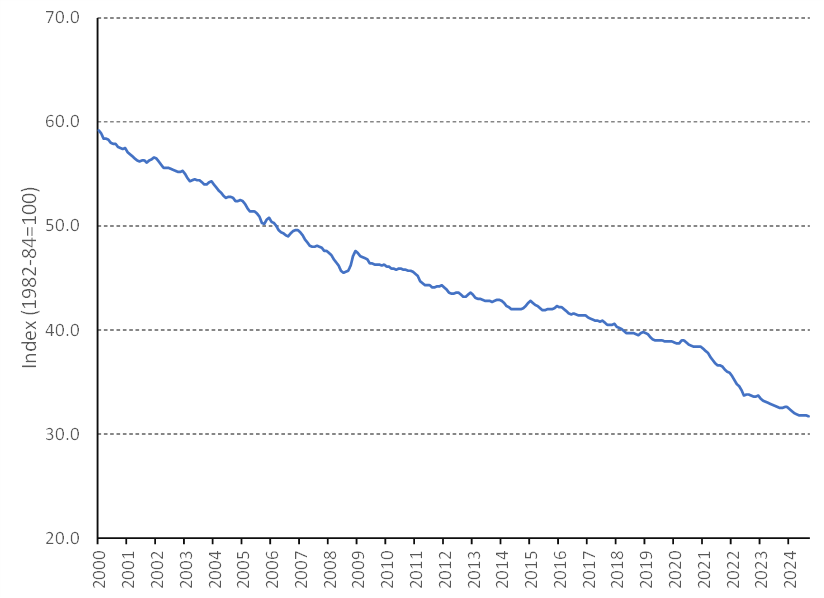

Bindseil and Schaff’s critique of Bitcoin’s wealth distribution also fails to recognize the broader implications of inflation within traditional financial systems. Fiat currency regimes redistribute wealth from savers to debt holders through inflationary policies, which continually erode the value of savings (Arslanalp et al., 2022). Bitcoin’s fixed supply and deflationary characteristics counteract this erosion, offering a long-term store of value. In contrast to fiat systems that devalue purchasing power over time (see Figure 1), Bitcoin provides a hedge against inflation.

Figure 1 – Decline in USA dollar purchasing power since 2000 (U.S. Bureau of Labor Statistics, retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CUUR0000SA0R, October 20, 2024)

This may be particularly pertinent in inflation-prone economies, where Bitcoin serves as an alternative to holding rapidly depreciating local currencies; even households in developed countries have, however, seen their purchasing power decline steadily for decades. By focusing exclusively on wealth redistribution within Bitcoin, the paper overlooks the more extensive redistributive effects of fiat systems and how Bitcoin can act as a safeguard for individuals against currency devaluation.

Furthermore, Bindseil and Schaff’s critique reflects a linguistic sleight of hand. “Redistribution” implies a deliberate action by some entity capable of unilaterally imposing its will on others. In reality, both holders of Bitcoin and fiat currency see the value of their assets change according to the perceptions of others in the market. Taken to its logical conclusion, Bindseil and Schaff’s argument suggests that holders of fiat have some sort of entitlement—whether legal, ethical, or otherwise is left unclear—to have others value their assets at a far higher rate than they actually do. This framing distorts the nature of market-driven asset valuation and mischaracterizes Bitcoin's market dynamics.

Bitcoin’s price continues to rise without adding to the productive capacity of the economy

Bindseil and Schaff argue that Bitcoin’s rising price is detached from the productive capacity of the economy, similar to speculative bubbles, and serves only to enrich holders without contributing to economic output. They assert that assets like Bitcoin, which have no inherent productive use, cannot sustainably generate long-term economic value and that Bitcoin's price appreciation reflects little more than speculative mania.

Bitcoin’s price rise has, as we noted earlier, driven significant technological innovation. These developments have broader applications beyond Bitcoin itself, contributing to economic growth by fostering advancements in cryptography, distributed systems, and financial technologies. Furthermore, Bitcoin’s rise has enabled the growth of decentralized financial systems that reduce intermediary costs, improve transaction efficiency, and increase access to financial services globally. The notion that Bitcoin’s price rise is detached from productivity overlooks the long-term economic impacts that its technological and financial innovations are already fostering, in payments technology, gaming, value-for-value business models, high-performance computing, and energy and infrastructure.

Furthermore, Bindseil and Schaff’s perspective fails to account for store-of-value assets like gold, which also do not directly contribute to productive capacity but hold value due to their scarcity and role in wealth preservation. Bitcoin operates similarly, providing an alternative store of value, particularly in periods of monetary instability. Its value derives from its fixed supply, decentralized structure, and scarcity, which parallel the same factors that make gold valuable as a hedge against inflation and currency debasement (Dyhrberg, 2016; Henriques and Sadorsky, 2018). The rise in Bitcoin’s price reflects increasing recognition of these properties, especially in contexts where fiat currencies are losing purchasing power.

Bitcoin lacks intrinsic value and cannot be priced using traditional asset valuation models

Bindseil and Schaff assert that Bitcoin lacks intrinsic value because it does not generate cash flows or contribute to traditional economic production. According to the authors, Bitcoin’s inability to be valued using traditional asset valuation models—such as discounted cash flow (DCF) analysis—renders it a speculative asset with no underlying worth. The implication is that Bitcoin’s price movements are driven purely by speculative demand, which makes it vulnerable to collapse.

However, this narrow definition of intrinsic value ignores the role that scarcity, decentralization, and utility as a store of value play in asset valuation. Similar to gold, which also lacks cash flows but has been used as a store of value for millennia, Bitcoin’s value is derived from its scarcity and ability to function as a non-sovereign store of wealth. Additionally, network effects—where the value of the network increases as more participants adopt Bitcoin—contribute to its growing utility and, consequently, its value. The economic value of network effects has long been recognized (Economides, 1996), so there is no valid reason to ignore them for an emerging financial technology like Bitcoin.

Bindseil and Schaff fail to recognize that Bitcoin represents a unique new asset class (see Larry Fink's comments about Bitcoin's emergence as a new, unique asset class) requiring different frameworks for valuation. Its value is tied to its fixed supply, security, and ability to serve as a hedge in inflationary environments, making the comparison to traditional valuation models inappropriate. Their argument is fundamentally flawed: they claim Bitcoin cannot be considered money because it cannot be valued as a security, whereas the reality is that it cannot be valued as a security precisely because it is money.

With regards to intrinsic values, Bindseil and Schaff also disregard Bitcoin’s increasingly important role in supporting human rights, especially in regions with authoritarian governments (Gladstein, 2022). Bitcoin has a pivotal role in bypassing state-imposed financial repression and supporting political dissidents. For example, when the Russian government froze the accounts of Alexei Navalny's Anti-Corruption Foundation (FBK), Bitcoin became a lifeline for continued operations. In the face of banking restrictions, educator and entrepreneur Roya Mahboob used Bitcoin to fund education for girls and women in Afghanistan (Gladstein, 2022). After having his bank accounts frozen by the government of Myanmar, political dissident Win Ko Ko Aung used Bitcoin to escape from the military regime after the 2021 coup. Similar stories are available from around the globe, where Bitcoin has provided a financial lifeline to those enduring hyperinflation, political persecution, or have had their access to financial services restricted. Bitcoin’s contribution to these kinds of societal benefits cannot be valued using discounted cash flow.

Bitcoin’s price movements are indicative of speculative bubbles

Bindseil and Schaff argue that Bitcoin’s volatile price movements signify a speculative bubble, likening it to the dot-com bubble or tulip mania (incidentally, historical research has shown that tulip mania was a hoax perpetrated by certain religious groups in protest at the growth of capitalism - see Goldgar, 2007). However, volatility is a characteristic of emerging technologies, and Bitcoin is still in the early stages of adoption. Like the internet stocks of the 1990s, Bitcoin’s volatility reflects uncertainty about its position in its adoption curve, not necessarily speculative mania.

Bitcoin’s price appreciation is driven by its scarcity, adoption, network effects, and recognition of its utility as a hedge against fiat currency debasement. Bitcoin’s price movements also correlate with broader macroeconomic trends, such as global liquidity and quantitative easing (Isah and Raheem, 2019), which drive demand for alternative stores of value. Institutional adoption, the availability of new derivative products, sovereign investments (e.g., Bhutan's move into Bitcoin mining with hydroelectric power - with Bitcoin's transparency, their daily Bitcoin income can be viewed online), adoption as legal tender (e.g., El Salvador – see Arslanian et al., 2021), all point to confidence in Bitcoin’s long-term outlook and continuing move up along the adoption curve.

Bindseil and Schaff’s simplistic comparison to historical financial bubbles ignores the deeper trends driving technological advance and oversimplifies the underlying economic and technological trends driving Bitcoin’s adoption.

Bitcoin has not fulfilled its original promise as a global payment system

Bindseil and Schaff argue that Bitcoin has failed as a global payment system due to high fees and scalability issues. Layer 2 solutions like the Lightning Network (Divakaruni and Zimmerman, 2023; Martinazzi and Flori, 2020; Poon and Dryja, 2016) have dramatically improved Bitcoin’s scalability, reducing fees and increasing transaction speed. These developments address Bitcoin’s early limitations, making it increasingly viable as a global payment system. By focusing on the early limitations, Bindseil and Schaff fail to acknowledge the significant progress made in improving its scalability and efficiency.

In their critique, Bindseil and Schaff claim that Nakamoto misinterpreted the nature of e-commerce and financial transactions, suggesting that mediation by financial institutions is merely an optional service rather than a technical necessity. They cite examples such as PayPal’s “friends and family” mode and bank transfers as evidence that financial institutions can operate without mediation (Benson et al., 2017; Stearns, 2021). However, this argument reflects a fundamental misunderstanding of Nakamoto’s analysis.

Nakamoto’s argument is not about the optionality of mediation in certain types of transactions; rather, it concerns the inherent costs and risks in a system where transactions rely on third-party credit institutions. In traditional systems, settlement of transactions is credit-based—meaning that both the buyer’s and seller’s financial institutions extend credit on behalf of their customers, settling through interbank systems and central banks (BIS, 2003). This process is not free, as it introduces risks of fraud, reversal, and non-finality before full settlement, all of which carry costs that are ultimately passed on to consumers through fees or other mechanisms.

By contrast, Bitcoin, as a bearer asset, provides immediate, final settlement at the point of transaction, without the need for a trusted third party. This is precisely what Nakamoto sought to address: the inefficiency and costs inherent in credit-based systems. The authors fail to grasp this core innovation, comparing Bitcoin’s design to fiat systems that necessarily involve many intermediaries. This misunderstanding of the technical foundation of Bitcoin invalidates Bindseil and Schaff’s broader critique of its suitability as a payment system.

The theoretical model

The theoretical model presented by Bindseil and Schaff attempts to frame Bitcoin as an inherently speculative and unstable asset. However, as we have outlined, the model is built on flawed assumptions and a narrow economic perspective, which significantly undermine its conclusions. Several critical issues with the model’s structure, assumptions, and omissions need to be addressed.

First, the model's overemphasis on Bitcoin's price volatility as an indicator of speculative bubbles is problematic. By focusing solely on volatility, the model fails to account for Bitcoin’s long-term adoption trends and growing institutional confidence, which suggest that price fluctuations may reflect the maturing of a novel asset class rather than speculative mania.

Second, the model's treatment of Bitcoin’s proof-of-work security mechanism is deeply flawed. Bindseil and Schaff argue that while Bitcoin's transaction history is impractical for an attacker to alter, proof-of-work is inefficient compared to other methods of securing payment systems, especially when considering the social cost of energy use. They claim that double-spending is not a significant issue in traditional payments, where it is resolved with lower costs than Bitcoin's proof-of-work approach.

However, this critique represents a fundamental misunderstanding of both the problem Bitcoin solves and the broader academic progress in cryptography and distributed systems that preceded it (Bayer et al., 1993; Back, 2002; Haber and Stornetta, 1991, 1997). Proof-of-work is not simply an inefficient alternative to existing payment systems but the only known solution to prevent double-spending without relying on a trusted third party. Traditional payment systems inherently require multiple trusted intermediaries, whereas Bitcoin’s innovation was its ability to function trustlessly.

This core aspect of Bitcoin’s design—avoiding third-party intermediaries—addresses vulnerabilities and inefficiencies present in fiat systems. Bindseil and Schaff’s argument overlooks the fundamental breakthrough of proof-of-work combined with the difficulty adjustment, a feature integral to Bitcoin’s decentralized consensus and the security of its network. To dismiss this as inefficient misses the important implications of Nakamoto's design, which solves the double-spending problem in a decentralized manner—something that centralized fiat systems, by definition, cannot do.

Third, Bindseil and Schaff assert that later investors are strictly a source of exit liquidity for early holders, which incorrectly frames the model as a zero-sum game. In Bitcoin’s case, it is quite likely that its ‘HODL’ culture means that a significant proportion of Bitcoin will never be re-sold. New banking services from traditional finance giants like Cantor Fitzgerald are emerging and will soon allow Bitcoin-backed loans.

Fourth, the model's failure to consider other asset classes that derive value beyond their immediate utility further weakens its conclusions. Real estate, for example, provides a clear utility as shelter, but over time, it has evolved into a store of value, particularly in inflationary environments. Housing, like Bitcoin, serves as a hedge against currency debasement and is often viewed as a hard asset to preserve wealth and purchasing power. This dynamic clearly illustrates that assets can have intrinsic value not merely from direct utility but from their ability to store value and serve as long-term investments.

Ironically, from a distributional perspective, the model’s dismissal of Bitcoin’s store-of-value function seems particularly out of touch given the declining purchasing power of even the strongest fiat currencies over time. Central banks, including the ECB, are themselves responsible for inflationary policies that erode the value of fiat money. As illustrated by the steady decline in purchasing power of the U.S. dollar (recall Figure 1) and Euro over the last few decades, the supposed stability of fiat currencies is undermined by their inflationary design. The distributional effects of long-term inflation and debasement include an increasing level of wealth inequity and a housing price crisis, along with all the social impacts that accompany the financial stresses that lower- and middle-income households face.

Flawed framing of CBDCs as superior

The paper positions CBDCs as superior to Bitcoin, but this framing rests on oversimplified assumptions that ignore Bitcoin’s unique strengths. By focusing narrowly on volatility and excluding Bitcoin’s economic and technological contributions, the authors present a skewed narrative favoring CBDCs.

First, the paper overlooks the risks of centralization inherent in CBDCs. While Bitcoin’s decentralized architecture ensures censorship resistance and financial sovereignty, CBDCs centralize monetary control, raising concerns about privacy, political manipulation, and surveillance. This centralization introduces significant risks, particularly in less democratic countries, yet the authors fail to address these concerns.

Second, the model assumes CBDCs will inherently promote financial stability, ignoring potential disruptions to traditional banking systems. The disintermediation of commercial banks through CBDC adoption could destabilize credit creation and the broader economy. The authors overlook these complexities while assuming CBDCs would automatically enhance stability.

Additionally, the paper's optimism about CBDCs' efficiency and financial inclusion fails to acknowledge Bitcoin’s existing contributions in these areas. Bitcoin already facilitates cross-border payments and financial inclusion in regions with unstable currencies, offering an alternative store of value. The authors dismiss these real-world use cases, underestimating Bitcoin’s role in advancing global financial access.

Finally, the assumption that CBDCs are immune to speculative risks is premature. Just like fiat currencies, CBDCs would be vulnerable to inflationary policies, capital controls, or political misuse. In contrast, Bitcoin’s fixed supply and decentralized governance provide a hedge against these risks, which the authors wrongly frame as flaws.

USA politics

One striking feature of Bindseil and Schaaf’s paper is its disproportionate focus on U.S. politics and lobbying efforts. The final paragraph of the paper clearly illustrates, with its focus not on economic analysis of Bitcoin but, instead, a politically charged narrative centering on the U.S. political landscape and its implications for Bitcoin. By singling out the U.S. presidential election and suggesting that pro-Bitcoin candidates are working to redistribute wealth in favor of early Bitcoin adopters, the paper frames Bitcoin as a tool for economic division. Bindseil and Schaaf’s political commentary raises important questions about the paper’s intended audience and purpose, as it steps away from its deficient economic analysis and delves into speculative political outcomes.

The implication that Bitcoin could sway election results in favor of politicians advocating for it injects a sense of urgency and fear, portraying Bitcoin as not only an economic threat but a political one. The concluding sentence (“Failing to do so could skew election results in favour of politicians who advocate pro-Bitcoin policies, implying wealth redistribution and fuelling [sic] the division of society”) serves as a clear indicator of how far the paper’s message extends beyond economics into the realm of political influence. Its focus on U.S. electoral dynamics and the need for “non-holders” to advocate against Bitcoin positions the paper as a tool for influencing public policy debates and electoral outcomes, rather than providing objective scholarly analysis.

Bindseil and Schaaf’s argument appears to be aimed more at shaping public or policymaker opinion – the domain of lobbyists – than contributing to an academic debate about the merits or risks of decentralized digital currencies. The ECB is ostensibly an apolitical and neutral organization, and the fact that Bindseil and Schaaf express political positions is inappropriate.

Potential author biases

The roles and professional responsibilities of the paper’s authors, Ulrich Bindseil and Jürgen Schaaf, introduce potential conflicts of interest that likely influence the framing of Bitcoin and the promotion of CBDCs. Both authors are deeply embedded within the ECB, with Bindseil serving as the Director General of Market Infrastructure and Payments and Schaaf as an Advisor to Senior Management in the same directorate. Their positions place them at the forefront of the ECB's efforts to design and implement a digital euro, a CBDC project that directly competes with decentralized digital currencies like Bitcoin.

Lead author Ulrich Bindseil’s professional work and public statements reflect a strong alignment with mainstream neo-Keynesian economic thought, particularly the belief that central banks are essential to maintaining monetary stability. His advocacy for CBDCs appears to be rooted in a broader commitment to state-managed monetary systems over decentralized, market-driven alternatives like Bitcoin. Bindseil's ongoing involvement in CBDC research underscores his consistent preference for state-backed digital solutions. He has frequently emphasized the need for central banks to adapt to the challenges posed by digital currencies, viewing decentralized alternatives such as Bitcoin as destabilizing forces in global financial systems. Similarly, Jürgen Schaaf plays a significant role in the ECB’s efforts to develop and promote a digital euro, further highlighting the institutional focus on CBDCs over decentralized models.

Given the ECB's strategic focus on developing a CBDC, it is reasonable to infer that the authors, at best, have a vested interest in portraying Bitcoin as an inferior, speculative asset. In reality, their prior ECB blog post condemns Bitcoin ETF approval, asserting that Bitcoin should be subject “to strong regulatory intervention, up to practically forbidding it.” By framing Bitcoin’s volatility and speculative tendencies as structural flaws, the authors create a narrative that strengthens their case for CBDCs as a safer, more stable alternative. This framing not only aligns with the ECB’s objectives but also serves to justify the institution’s ongoing efforts to retain control over monetary systems in the digital age.

Conclusion

Bindseil and Schaaf frame Bitcoin as a speculative and unstable asset while promoting CBDCs as the superior solution for the future of digital finance. However, a deeper analysis of their working paper reveals fundamental flaws in Bindseil and Schaaf’s assumptions and theoretical model, as well as a basic misunderstanding of Bitcoin’s technological fundamentals and advances. Their overreliance on Bitcoin’s price volatility as an indicator of instability ignores the broader context of emerging technologies, where volatility is often a characteristic of early-stage adoption. This narrow focus also overlooks the real-world benefits Bitcoin offers in financial inclusion, cross-border payments, and technological innovation.

In addition to these analytical shortcomings, the paper’s emphasis on U.S. political dynamics—culminating in a narrative about the potential impact of Bitcoin on U.S. elections—suggests that the authors have gone beyond neutral academic analysis and are aiming to influence public policy debates. This overt political framing, which does not fit with the paper’s supposed economic focus, raises questions about its intended audience and the objectivity of its conclusions.

Bindseil and Schaaf’s professional roles at the ECB introduce potential conflicts of interest that further undermine the paper’s credibility. Their vested interest in advancing CBDCs likely skews their portrayal of Bitcoin as a speculative asset, while ignoring the considerable risks posed by CBDCs, such as state surveillance, financial instability, and the loss of privacy.

Given these significant flaws, the paper’s conclusions clearly render their preprint unsuitable for academic publication. The combination of methodological weaknesses and personal or institutional biases undermines the rigor and objectivity required for scholarly inquiry: the working paper fails to provide a credible analysis of the utility or future of Bitcoin.

Comments ()