Forecasting Bitcoin Price Trajectories Using Supply and Demand Dynamics

This post gives a non-technical summary of our new Satoshi Action working paper. We developed a Bitcoin supply-and-demand framework and model for forecasting Bitcoin price trajectories out to 2036.

I'm happy to post this summary of a new paper that develops a supply-and-demand framework and model for forecasting Bitcoin price trajectories out to 2036. Dennis Porter is a coauthor for this Satoshi Action Education project.

For non-technical readers, I ran my standard academic paper summary below.

Article Summary

Article

Rudd, M.A., D., Porter, D., 2024. Forecasting Bitcoin price trajectories using a supply and demand framework. SSRN working paper available at: https://dx.doi.org/10.2139/ssrn.5059523

The price prediction outputs from our model are available on figshare: https://doi.org/10.6084/m9.figshare.27997877.v2

Update: the final version of the 2025 academic article is available in the Journal of Risk and Financial Management: https://doi.org/10.3390/jrfm18020066.

Also note that I am working on a follow-up paper that uses an updated Epstein-Zin utility function and accounts for HODLed Bitcoin re-entering the market as prices rise; I hope the working paper will be available in Summer 2025.

Summary

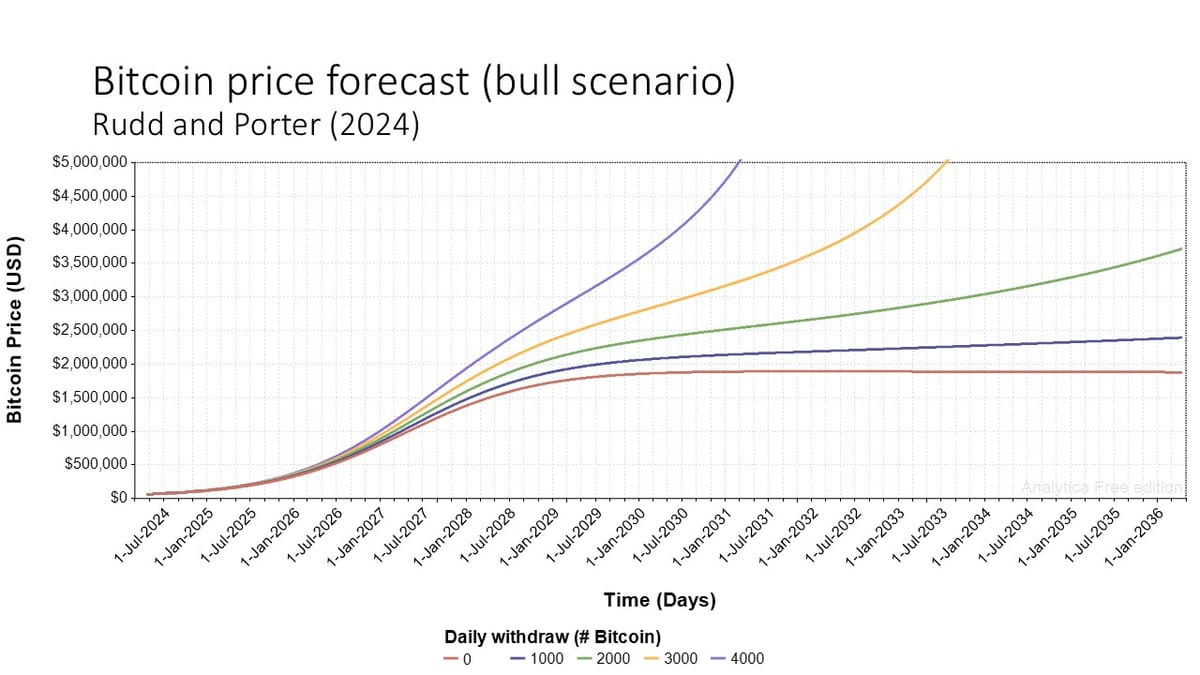

Our new working paper introduces a highly-flexible Bitcoin price forecasting framework based on supply and demand equilibrium theory. By integrating Bitcoin’s fixed, inelastic supply with a demand curve driven by institutional adoption and strategic reserve accumulation, the framework highlights how market dynamics could lead to significant price appreciation. Our findings from the initial model reveal the importance of growing institutional demand, a looming supply shock, and potentially hyperbolic price increases, offering valuable insights for investors and policymakers.

Take-Home Messages

- Fixed Supply Drives Volatility: Bitcoin’s inelastic supply creates conditions for extreme price volatility as adoption rises.

- Institutional Demand Matters: Even relatively modest Bitcoin allocations by global funds or nation states could trigger significant price increases.

- Supply Shocks are Possible: National reserve accumulation and long-term holding could deplete Bitcoin’s liquid supply.

- Expect Price Volatility: Unlike the Power Law model, a supply- and demand-based model implies increased price volatility over time.

- Research is Needed: Improved models are essential for accurate price forecasting and risk management under high uncertainty.

Overview

Bitcoin’s fixed supply of 21-million coins creates an inelastic market structure that distinguishes it from other financial assets. Our framework starts from the fourth Bitcoin halving in April 2024, incorporating a Constant Elasticity of Substitution (CES) demand curve to simulate future price scenarios. As issuance decreases over time due to scheduled halving events, and liquid supply is transferred to reserves, the limited supply becomes increasingly important.

Our model suggests that institutional and national reserve investments could create a severe Bitcoin supply shock. Even modest increases in demand could trigger substantial price increases over the next 12-years due to the fixed supply.

The model considers conservative and bull scenarios of demand growth and supply withdrawals, demonstrating how combined forces might push Bitcoin's price toward hyperbolic trajectories. While institutional adoption typically drives steady price appreciation, sustained daily withdrawals could cause Bitcoin’s value to rise rapidly.

Implications

Our supply-demand model suggests volatile and potentially hyperbolic price trajectories under scenarios involving significant institutional accumulation or strategic Bitcoin withdrawals from liquid supply. Our findings stand in contrast to the assumption, based on power law analysis, that Bitcoin price will stablize as it is institutionalized, and that it will exhibit diminishing returns over time.

If real-world conditions align more closely with the supply-demand model’s assumptions—particularly concerning constrained liquidity and aggressive institutional adoption—then future Bitcoin prices could significantly outpace power-law predictions. Market participants should expect high volatility when forecasting returns and planning risk management.

Future Outlook

Bitcoin’s future depends on how global stakeholders navigate adoption, regulation, and financial innovation. Research into more dynamic price models, improved liquidity metrics, and adaptive regulatory frameworks will be essential for a sustainable Bitcoin-driven financial future.

The outputs from this framework can be customized for investors and fund managers, depending on their beliefs and mandates. Model outputs - price vectors - will be invaluable for forward-oriented portfolio allocation modeling, helping investors to manage risk and increase performance.

Information Gaps

- How Can Bitcoin’s Price Volatility Be Mitigated Given Its Perfectly Inelastic Supply? Mitigating Bitcoin’s price volatility could stabilize global markets and enhance its viability as a strategic reserve asset. Addressing this question could inspire new financial instruments, stabilization mechanisms, and policy innovations critical for Bitcoin’s integration into global portfolios.

- How Could Nations Coordinate Bitcoin Reserve Accumulation to Prevent Global Liquidity Crises? With the potential for geopolitical competition over Bitcoin reserves, international coordination could reduce risks of liquidity shortages and market instability. Answering this question would help inform cooperative frameworks to balance national interests with global economic stability.

- How Would Hyperbolic Bitcoin Price Increases Disrupt Fiat-Based Global Financial Systems? Understanding the systemic risks of hyperbolic Bitcoin price increases could inform financial regulators about potential disruptions in traditional banking and monetary systems. This would enable timely regulatory interventions to avoid financial crises linked to depreciating fiat currencies.

- How Can Liquid Bitcoin Supply Be More Accurately Estimated in Real-Time? Accurately estimating Bitcoin’s liquid supply is critical for precise price forecasting. Current models rely on assumptions about lost coins, dormant wallets, and long-term holdings, which are inherently uncertain. Improved blockchain analytics, including machine learning-based wallet activity classification, could refine liquid supply estimates. Addressing this gap would enhance the reliability of Bitcoin pricing models and help investors and policymakers anticipate potential supply shocks more effectively.

- How Will Scaling Technologies Like the Lightning Network Impact Bitcoin's Long-Term Valuation? The Lightning Network and similar technologies could reshape Bitcoin’s utility and price dynamics by enabling widespread adoption while minimizing on-chain congestion. Understanding this relationship could shape both market expectations and technological development priorities.

Broader Implications for Bitcoin

Institutional Bitcoin Accumulation and Market Power

As institutional adoption intensifies, large entities may gain significant market power over Bitcoin's supply. This centralization risk could conflict with Bitcoin’s decentralized ethos, creating power imbalances. National reserves and corporate treasuries accumulating Bitcoin may control liquidity, influencing price stability and market access.

Geopolitical and Economic Competition

Bitcoin’s status as a potential reserve asset may ignite geopolitical competition, with nations competing to secure limited supply. This could intensify international monetary tensions, driving strategic accumulation and reducing liquidity. Global cooperation frameworks, similar to those governing gold reserves, might become necessary to manage Bitcoin’s global economic role.

Technological Scaling and Network Evolution

The evolution of Layer 2 technologies like the Lightning Network could redefine Bitcoin’s role from a speculative asset to a global currency. The continued development of open, decentralized infrastructure is critical for maintaining Bitcoin’s trustless system.

Social and Economic Inequality

As Bitcoin prices surge, wealth inequality could deepen, with early adopters benefiting disproportionately. If large institutions dominate Bitcoin accumulation, retail investors may struggle to participate meaningfully. Policymakers should consider social equity implications and explore policies that promote fair access and community-driven reserve funds.

Comments ()