Research Reviews

My 'Research Reviews' focus specifically on article content: the summaries do not reflect my personal opinions. I create reviews to help identify papers I want to read in detail, verifying methodologies, results, and implications as needed (i.e., I am just sharing some of my own research due diligence).

My 'Critical Reviews' go into more depth. I dissect the article, highlight strengths and weaknesses, assess author and journal credibility, and provide some personal opinions about the paper.

Don't take and of these reviews as gospel: DYOR if you need to get the facts right!

State-Sponsored Bitcoin Burning

The March 2025 Oosthoek et al. working paper from Delft University of Technology reveals how unauthorized OP_RETURN transactions burned over 7 BTC, linking the activity to Russian intelligence operations.

Challenging ECB’s Bitcoin Critique: a Critical Rebuttal

Our paper critiques the recent working paper by Bindseil and Schaff (2024), which presents a negative assessment of Bitcoin’s long-term viability, framing it as a speculative asset with limited intrinsic value and significant risks.

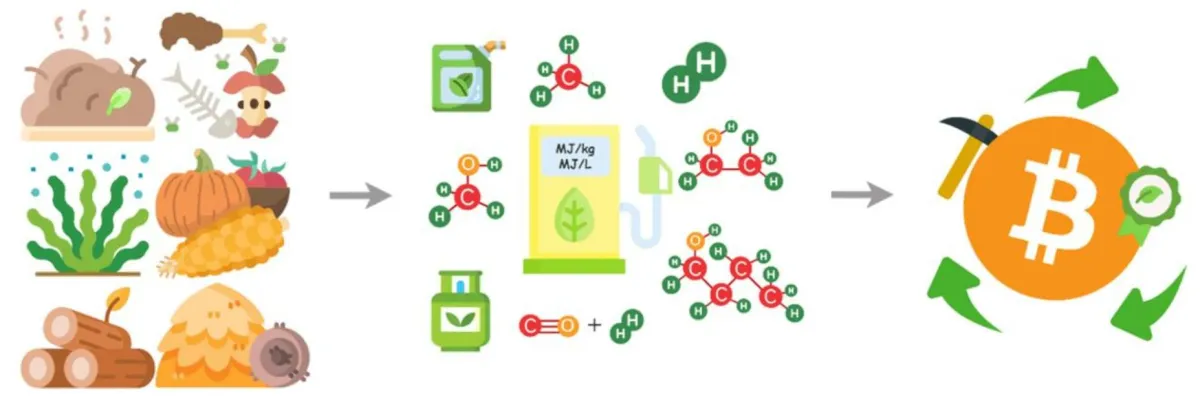

Bitcoin Mining in Biorefineries: Boosting Profitability

Full article summary: Semaan, G., Wang, G., Vo, Q.S., Kumar, G., 2024. The potential relationship between biomass, biorefineries, and Bitcoin. Sustainability 16, 7919.

Bitcoin and Portfolio Allocation: Insights from BlackRock’s Research

In this post, I deep dive into BlackRock’s research article on Bitcoin’s returns, strong positive skewness, and implications for allocating Bitcoin to investment portfolios. Could this be the paper that set off the ETF gold rush?

On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier?

Full article summary: Bouri, E., Molnár, P., Azzi, G., Roubaud, D., Hagfors, L.I., 2017. On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier? Finance Research Letters 20, 192-198.

The influence of Bitcoin on portfolio diversification and design

Full article summary: Akhtaruzzaman, M., Sensoy, A., Corbet, S., 2020. The influence of Bitcoin on portfolio diversification and design. Finance Research Letters 37, 101344.

Virtual Currency, Tangible Return: Portfolio Diversification with Bitcoin

Full article summary: Brière, M., Oosterlinck, K., Szafarz, A., 2015. Virtual currency, tangible return: portfolio diversification with bitcoin. Journal of Asset Management 16, 365-373.

Subjective models of the macroeconomy: evidence from experts and representative samples

Full article summary: Andre, P., Pizzinelli, C., Roth, C., Wohlfart, J., 2022. Subjective models of the macroeconomy: evidence from experts and representative samples. The Review of Economic Studies 89, 2958-2991.

On the value of virtual currencies

Full article summary: Bolt, W., Van Oordt, M.R.C., 2020. On the value of virtual currencies. Journal of Money, Credit and Banking 52, 835-862.

Take Bitcoin into your portfolio: a novel ensemble portfolio optimization framework for broad commodity assets

Full article summary: Li, Y., Jiang, S., Wei, Y., Wang, S., 2021. Take Bitcoin into your portfolio: a novel ensemble portfolio optimization framework for broad commodity assets. Financial Innovation 7, 63.

Should investors include Bitcoin in their portfolios? A portfolio theory approach

Full article summary: Platanakis, E., Urquhart, A., 2020. Should investors include Bitcoin in their portfolios? A portfolio theory approach. The British Accounting Review 52, 100837.

Portfolio diversification benefits of alternative currency investment in Bitcoin and foreign exchange markets.

Full article summary: Qarni, M.O., Gulzar, S., 2021. Portfolio diversification benefits of alternative currency investment in Bitcoin and foreign exchange markets. Financial Innovation 7, 17.

Can Texas mitigate wind and solar curtailments by leveraging bitcoin mining?

Full article summary: Niaz, H., Liu, J.J., You, F., 2022. Can Texas mitigate wind and solar curtailments by leveraging bitcoin mining? Journal of Cleaner Production 364, 132700.

Climate sustainability through a dynamic duo: green hydrogen and crypto driving energy transition and decarbonization.

Full article summary: Lal, A., You, F., 2024. Climate sustainability through a dynamic duo: green hydrogen and crypto driving energy transition and decarbonization. Proceedings of the National Academy of Sciences 121, e2313911121.

Happiness and Time Preference: The Effect of Positive Affect in a Random-Assignment Experiment

Full article summary: Ifcher, J., Zarghamee, H., 2011. Happiness and time preference: the effect of positive affect in a random-assignment experiment. American Economic Review 101, 3109-3129.

Discounting and global environmental change

Full article summary: Polasky, S., Dampha, N.K., 2021. Discounting and global environmental change. Annual Review of Environment and Resources 46, 691-717. https://doi.org/10.1146/annurev-environ-020420-042100

Monetary policy and Bitcoin

Full article summary: Karau, S., 2023. Monetary policy and Bitcoin. Journal of International Money and Finance 137, 102880.

Time discounting and time preference: a critical review

Full article summary: Frederick, S., Loewenstein, G., O’Donoghue, T., 2002. Time discounting and time preference: a critical review. Journal of Economic Literature 40, 351-401.

Can cryptocurrencies fulfill the functions of money?

Full article summary: Ammous, S., 2018. Can cryptocurrencies fulfil the functions of money? The Quarterly Review of Economics and Finance 70, 38-51.

Managing a Multiple Reserve Currency World

Full article summary: Eichengreen, B., 2010. Managing a multiple reserve currency world, in: Sachs, J.D., Kawai, M., Lee, J.-W., Woo, W.T. (Eds.), The Future Global Reserve System: An Asian Perspective. Asian Development Bank, Manila.

Do central banks rebalance their currency shares?

Full article summary: Chinn, M.D., Ito, H., McCauley, R.N., 2022. Do central banks rebalance their currency shares? Journal of International Money and Finance 122, 102557.

The philosophy of Bitcoin and the question of money

Full article summary: Butler, S., 2022. The philosophy of Bitcoin and the question of money. Theory, Culture & Society 39, 81-102.

Fiat money

Full article summary: Wallace, N., 2010. Fiat Money, in: Durlauf, S.N., Blume, L.E. (Eds.), Monetary Economics. Palgrave Macmillan UK, London, pp. 66-75.

Reserve currency blocs: a changing international monetary system?

Full article summary: Tovar, C.E., Nor, T.M., 2018. Reserve currency blocs: a changing international monetary system? International Monetary Fund. IMF working paper no. 18/20

Is Bitcoin a currency, a technology-based product, or something else?

Full article summary: White, R., Marinakis, Y., Islam, N., Walsh, S., 2020. Is Bitcoin a currency, a technology-based product, or something else? Technological Forecasting and Social Change 151, 119877.

Should cryptocurrencies be included in the portfolio of international reserves held by central banks?

Full article summary: Moore, W., Stephen, J., 2016. Should cryptocurrencies be included in the portfolio of international reserves held by central banks? Cogent Economics & Finance 4, 1147119.

Some unpleasant monetarist arithmetic

Full article summary: Sargent, T.J., Wallace, N., 1981. Some unpleasant monetarist arithmetic. Federal Reserve Bank of Minneapolis Quarterly Review 5, 1-17.

Towards a New Global Reserve System

Full article summary: Stiglitz, J.E., Greenwald, B., 2010. Towards a new global reserve system. Journal of Globalization and Development 1, 10.

Survey of Time Preference, Delay Discounting Models

Full article summary: Doyle, J.R., 2013. Survey of time preference, delay discounting models. Judgment and Decision Making 8, 116-135.

Reserve Currencies in an Evolving International Monetary System

Full article summary: Iancu, A., Anderson, G., Ando, S., Boswell, E., Gamba, A., Hakobyan, S., Lusinyan, L., Meads, N., Wu, Y., 2022. Reserve currencies in an evolving international monetary system. Open Economies Review 33, 879-915.

The rise and fall of the dollar (or when did the dollar replace sterling as the leading reserve currency?)

Full article summary: Eichengreen, B., Flandreau, M., 2009. The rise and fall of the dollar (or when did the dollar replace sterling as the leading reserve currency?) European Review of Economic History 13, 377-411.

Bitcoin: A new digital gold standard in the 21st century?

Full article summary: Taskinsoy, J., 2021. Bitcoin: A new digital gold standard in the 21st century? SSRN preprint.

Individual Time Preferences and Energy Efficiency

Full article summary: Newell, R.G., Siikamäki, J., 2015. Individual time preferences and energy efficiency. American Economic Review 105, 196-200.

Evaluating Bitcoin as Legal Tender in El Salvador

In this blog post, we dig into the study “Are cryptocurrencies currencies? Bitcoin as legal tender in El Salvador” by Alvarez, Argente, and Van Patten, published in Science. Read on to explore the key findings from our review.

How time preferences differ: evidence from 53 countries

Full article summary: Wang, M., Rieger, M.O., Hens, T., 2016. How time preferences differ: evidence from 53 countries. Journal of Economic Psychology 52, 115-135.

Mars or Mercury? The Geopolitics of International Currency Choice

This research review is entirely generated by AI: if you are going to use my summary, DYOR.

Evolving Dynamics of Global Reserve Currencies: The Stealth Erosion of Dollar Dominance

Full article summary: Arslanalp, S., Eichengreen, B., Simpson-Bell, C., 2022. The stealth erosion of dollar dominance and the rise of nontraditional reserve currencies. Journal of International Economics 138, 103656.