On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier?

Full article summary: Bouri, E., Molnár, P., Azzi, G., Roubaud, D., Hagfors, L.I., 2017. On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier? Finance Research Letters 20, 192-198.

This article summary is part of my personal background research work. The top part of each post had a detailed summary of the article. Scroll farther down the page for the article's broader implications for Bitcoin. Given the foundational nature of this article, I went into quite some detail.

(1) Article Summary

Link

https://doi.org/10.1016/j.frl.2016.09.025

Keywords

- Bitcoin

- Diversification

- Hedge

- Safe haven

- Dynamic conditional correlation (DCC) model

- Financial markets

- Risk management

- Volatility

- Asset allocation

- Time horizons

Short summary

The paper investigates whether Bitcoin can serve as a hedge or safe haven against various financial assets, including stock indices, bonds, oil, gold, commodities, and the US dollar. Utilizing a dynamic conditional correlation (DCC) model with daily and weekly data from July 2011 to December 2015, the authors find that Bitcoin is generally a poor hedge and is better suited as a diversifier. However, Bitcoin does exhibit safe haven properties, particularly in response to extreme negative movements in Asian stock markets. The results highlight that Bitcoin's hedging and safe haven capacities vary depending on the time horizon, with stronger effects observed over weekly intervals compared to daily data.

Distinguishing Between Diversifier, Hedge, and Safe Haven Roles

This paper was the first to distinguish among these three roles for Bitcoin. Understanding the roles of financial assets—specifically, whether they serve as diversifiers, hedges, or safe havens—is crucial for effective portfolio management. These concepts are often discussed in the context of risk management, and they reflect how an asset behaves relative to other assets, particularly during periods of market turbulence. Below is a detailed explanation of each role:

1. Diversifier:

- Definition: A diversifier is an asset that has a weak positive correlation with other assets within a portfolio on average. This means that while the asset's price may move in the same direction as other assets, it does so to a lesser degree, thereby offering some level of diversification.

- Role in Portfolio: Diversifiers help to reduce overall portfolio risk by spreading exposure across assets that do not move in perfect unison. Although they might not provide protection during extreme market downturns, they contribute to risk reduction by ensuring that not all assets in the portfolio experience significant losses at the same time.

- Example: In the context of the study, Bitcoin is found to be an effective diversifier against many financial assets, such as the S&P 500 and other major stock indices. Its weak positive correlation with these assets allows investors to reduce risk by including Bitcoin in their portfolios.

2. Hedge:

- Definition: A hedge is an asset that is uncorrelated (weak hedge) or negatively correlated (strong hedge) with another asset on average. A strong hedge is particularly valuable because it tends to gain value or maintain stability when the other asset declines, thereby providing protection against losses.

- Role in Portfolio: Hedges are used to offset potential losses in a portfolio. By including a hedge, investors can protect against adverse price movements in other assets. The effectiveness of a hedge depends on the strength and consistency of its negative correlation with the targeted asset.

- Example: The study shows that Bitcoin acts as a strong hedge against Japanese and Asia Pacific stocks, especially during daily market fluctuations. This means that when these stock markets decline, Bitcoin tends to increase in value or remain stable, helping to protect the investor's portfolio from significant losses.

3. Safe Haven:

- Definition: A safe haven is an asset that is uncorrelated (weak safe haven) or negatively correlated (strong safe haven) with another asset during times of extreme market stress or financial crisis. Unlike a hedge, which provides ongoing protection, a safe haven specifically offers refuge during periods of severe market turmoil.

- Role in Portfolio: Safe haven assets are crucial for protecting portfolios during market crashes or economic crises. They are sought after because they tend to preserve or even increase in value when most other assets are experiencing sharp declines. The key characteristic of a safe haven is its performance during the worst market conditions.

- Example: In the study, Bitcoin is identified as a strong safe haven for Chinese and Asia Pacific stocks during extreme downturns, particularly in weekly data. This implies that during severe market stress in these regions, investors might flock to Bitcoin as a protective measure, thereby driving up its value when other assets are plummeting.

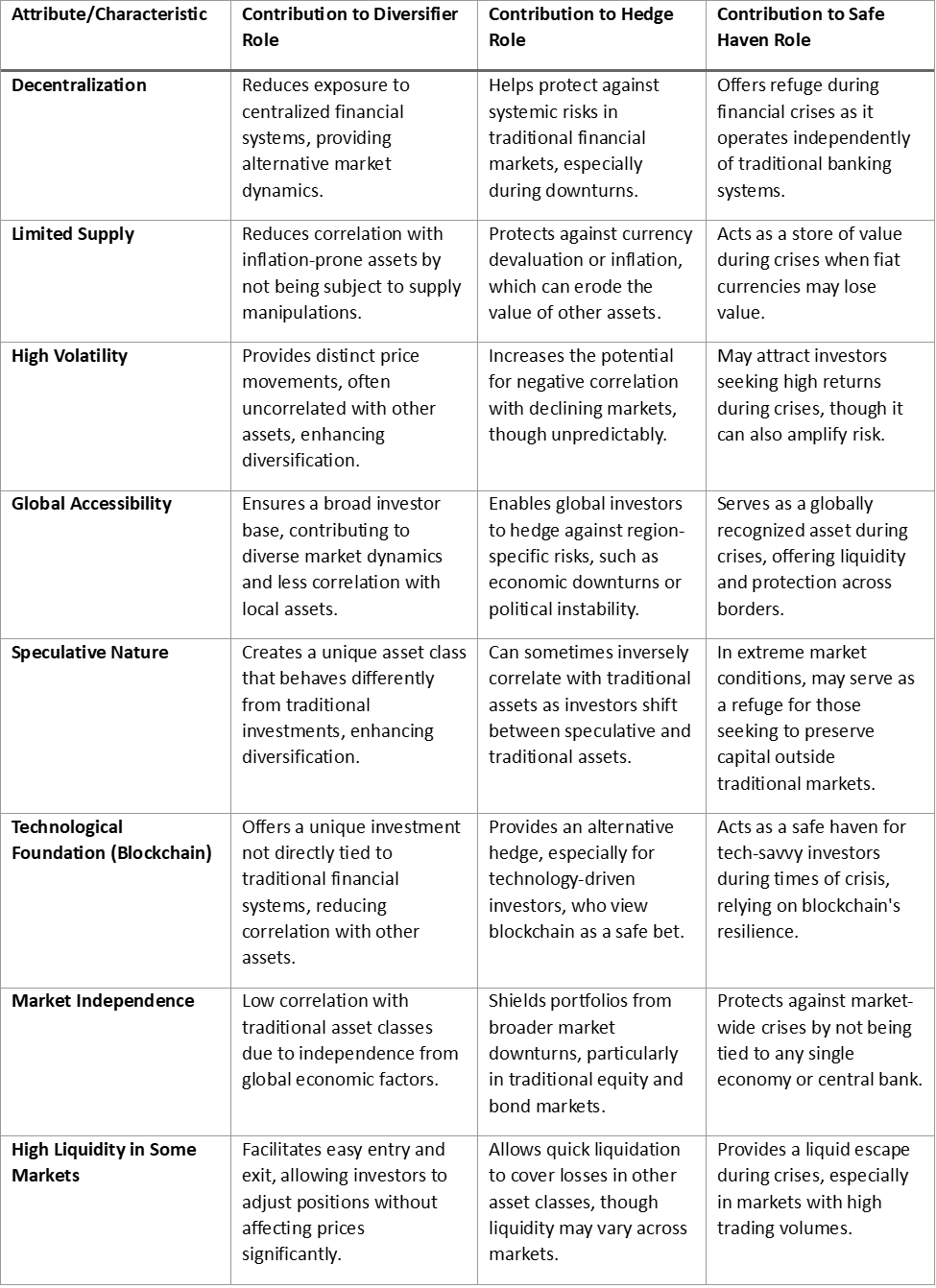

Below is a table that summarizes how Bitcoin’s attributes contribute to its potential roles as a diversifier, hedge, and safe haven, depending on the context in which it is used and the market conditions at play.

Methodology:

The methodology of the paper revolves around the use of the Dynamic Conditional Correlation (DCC) model, a variant of the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models. This approach is selected because of its ability to capture time-varying correlations between assets, making it suitable for assessing the hedging and safe haven properties of Bitcoin against various financial assets.

Data Collection: The study uses daily and weekly data spanning from July 18, 2011, to December 22, 2015. The data includes price indices for Bitcoin and several financial assets, such as stock indices (S&P 500, FTSE 100, DAX 30, Nikkei 225, Shanghai A-share), bonds (Pimco Investment Grade Corporate Bond Index ETF), commodities (SPGS Commodity Index, Brent Crude oil, gold), and currencies (US dollar index). Bitcoin prices are represented by the exchange rate to US dollars from the Bitstamp marketplace.

Preliminary Data Analysis: The authors begin by calculating returns as the first difference of the logarithm of closing prices for each asset. They then compute summary statistics, including mean, maximum, minimum, standard deviation, skewness, and kurtosis for both daily and weekly returns. This preliminary analysis reveals the high volatility of Bitcoin compared to other assets.

Dynamic Conditional Correlation (DCC) Model:

- Step 1: GARCH Model Estimation:

- The first step in the DCC model involves estimating a univariate GARCH (1,1) model for each asset's return series. The GARCH model is used to capture the time-varying conditional variances of the return series.

- This model helps account for the autoregressive conditional heteroskedasticity commonly observed in financial return series.

- Step 2: Estimation of Time-Varying Correlations:

- The second step involves estimating the time-varying correlations between Bitcoin and each of the other assets using the DCC model. The DCC model allows the conditional correlation matrix to vary over time, providing a more flexible and accurate representation of the relationship between assets.

Assessment of Hedge and Safe Haven Properties: The pairwise dynamic conditional correlations (DCCs) between Bitcoin and the other assets are extracted and regressed on dummy variables representing extreme market movements. This regression helps to assess whether Bitcoin acts as a diversifier, hedge, or safe haven.

Diagnostics and Model Validation: The model's fit is validated using diagnostics tests to check for autocorrelation and heteroscedasticity in the residuals. The authors report that the selected model is well-fitted, with no significant autocorrelation or heteroscedasticity detected in the return series. Additionally, most coefficients in the mean, variance, and DCC equations are significant at the 5% level, indicating a high degree of persistence in the variance process.

Data Frequency Analysis: The study examines the results separately for daily and weekly data to explore how the time horizon affects Bitcoin’s hedge and safe haven properties. This analysis reveals that Bitcoin's properties vary significantly depending on whether daily or weekly data is used, suggesting that different factors drive Bitcoin’s performance over different time horizons.

Results

- Daily Analysis:

- The results from the daily data analysis indicate that Bitcoin generally does not serve as a strong safe haven for most assets studied. Specifically, Bitcoin fails to act as a safe haven against extreme downward movements in the S&P 500, FTSE 100, DAX 30, and other major stock indices, bonds, and commodities. The coefficients for the extreme quantiles (m1, m2, m3) in the regression model are either insignificant or positive, suggesting that Bitcoin's role as a safe haven is limited at best.

- However, Bitcoin does exhibit some hedging properties in specific cases. For example, it acts as a strong hedge against Japanese and Asia Pacific stocks, meaning that it tends to negatively correlate with these assets during market downturns. This finding implies that investors in these regions might use Bitcoin to protect their portfolios from adverse equity market movements. Additionally, Bitcoin serves as a hedge for the general commodity index, indicating its ability to reduce risks associated with fluctuations in commodity prices.

- Bitcoin’s role as a diversifier is consistently observed across various assets. The positive and significant coefficients (m0) in the regression analysis indicate that Bitcoin, on average, has a weak positive correlation with other assets, making it an effective diversifier. This diversification benefit is particularly pronounced in its relationship with the US stock market, where Bitcoin does not hedge against negative movements but provides portfolio diversification.

- Weekly Analysis:

- The weekly data analysis provides a different perspective, highlighting the importance of time horizons in understanding Bitcoin's risk management properties. Unlike the daily analysis, Bitcoin emerges as a strong hedge against movements in Chinese stocks, as indicated by the significantly negative coefficient (m0) for this market. This suggests that over a longer time frame, Bitcoin can effectively reduce risks associated with the Chinese equity market.

- The weekly analysis also reveals that Bitcoin acts as a strong safe haven against extreme movements in the Chinese and Asia Pacific stock markets, particularly during severe downturns (5% and 10% quantiles). This safe haven role is significant for investors looking to protect their portfolios during periods of financial stress in these regions. The preference for Bitcoin in these markets might be due to its decentralized nature and independence from traditional financial systems, which investors might find appealing during crises.

- A key observation from the weekly data is that Bitcoin's hedging and safe haven properties vary considerably between daily and weekly time horizons. For instance, while Bitcoin hedges against Japanese stocks in daily data, this property diminishes in the weekly analysis. Conversely, Bitcoin's safe haven role in Asia Pacific markets, which is weak in daily data, becomes more prominent over the weekly horizon. This variability underscores the influence of speculative behavior and short-term price fluctuations on Bitcoin’s daily performance, which might be less pronounced when considering longer time frames.

- Comparison Between Daily and Weekly Results:

- The comparison between daily and weekly results highlights that Bitcoin's effectiveness as a hedge or safe haven is time-sensitive. For example, while Bitcoin hedges against the commodity index in daily data, this effect disappears in the weekly analysis. Conversely, Bitcoin gains both hedging and safe haven properties for Chinese stocks in the weekly analysis, which were not evident in the daily data.

- These findings suggest that investors might need to consider different strategies depending on their investment horizon. The speculative nature of Bitcoin, characterized by high volatility and frequent price swings, seems to undermine its daily safe haven properties, whereas its role as a safe haven is more evident when viewed over longer periods.

Implications

The findings suggest that while Bitcoin has some potential as a risk management tool, its role is limited to specific circumstances, particularly in Asian markets. For investors and policymakers, Bitcoin should not be relied upon as a universal hedge or safe haven but rather as a complementary asset that can provide diversification benefits. The study's results also indicate that the effectiveness of Bitcoin as a hedging tool varies across time horizons, emphasizing the need for further research on the time-varying nature of its risk management properties.

Issues

Bitcoin's Limited Hedge Capacity: Bitcoin’s hedge properties are limited to specific markets and timeframes. This limitation raises questions about its effectiveness as a broad-based hedging tool.

Safe Haven Properties in Asian Markets: Bitcoin exhibits safe haven properties primarily in Asian markets, suggesting regional preferences and market-specific dynamics.

Time Horizon Sensitivity: The effectiveness of Bitcoin as a hedge or safe haven is sensitive to the time horizon, complicating its application in portfolio management.

Volatility Impact: The high volatility of Bitcoin may undermine its utility as a reliable safe haven, particularly in the short term.

Market Conditions: The study is based on data from a period of significant market turbulence, which may not fully represent Bitcoin's behavior in more stable conditions.

Liquidity Concerns: Bitcoin's liquidity remains an issue, potentially affecting its role in risk management strategies.

Speculative Nature: Bitcoin’s speculative characteristics may detract from its potential as a safe haven, particularly for risk-averse investors.

Diversification Benefits: While Bitcoin provides diversification benefits, these may be insufficient to justify its inclusion in all portfolios.

Regulatory Uncertainty: The evolving regulatory landscape could impact Bitcoin's future role as a hedge or safe haven.

Data Limitations: The study’s conclusions are based on a specific dataset and period, which may limit the generalizability of the findings.

Open Questions

Bitcoin's Limited Hedge Capacity

- What factors contribute to Bitcoin’s limited ability to hedge against major financial assets?

- How might Bitcoin's hedging capacity evolve with changes in market structure and regulation?

Safe Haven Properties in Asian Markets

- What unique market conditions in Asia contribute to Bitcoin’s role as a safe haven in these regions?

- Could Bitcoin's safe haven properties be replicated in other emerging markets, and if so, how?

Time Horizon Sensitivity

- What drives the differences in Bitcoin’s hedging and safe haven properties across daily and weekly time horizons?

- How could investors optimize Bitcoin’s role in their portfolios based on different investment horizons?

Volatility Impact

- How does Bitcoin's high volatility affect its reliability as a hedging tool during market downturns?

- Could future market stabilization or changes in Bitcoin’s volatility profile alter its risk management role?

Market Conditions

- How would Bitcoin perform as a hedge or safe haven during periods of prolonged market stability?

- What market conditions could significantly alter Bitcoin’s effectiveness as a risk management tool?

Liquidity Concerns

- How does the relative liquidity of Bitcoin compare with traditional hedging assets like gold or government bonds?

- What mechanisms could improve Bitcoin’s liquidity, making it a more reliable hedge or safe haven?

Speculative Nature

- To what extent does Bitcoin’s speculative nature undermine its potential as a hedge or safe haven?

- Could regulatory changes or increased institutional adoption reduce Bitcoin’s speculative behavior, thereby enhancing its risk management capabilities?

Diversification Benefits

- What specific characteristics of Bitcoin contribute most to its role as a diversifier in various market environments?

- How does Bitcoin’s diversification benefit compare with other alternative assets, such as commodities or real estate?

Regulatory Uncertainty

- How might evolving regulatory frameworks impact Bitcoin’s role as a hedge or safe haven?

- Could standardized global regulations enhance Bitcoin’s stability and predictability as a risk management tool?

Data Limitations

- How might the results of the study differ if newer data reflecting more recent market conditions were included?

- What are the implications of data limitations on the generalizability of Bitcoin’s risk management properties?

Five Key Research Needs

- Volatility Impact on Hedging Reliability: Bitcoin’s high volatility is a double-edged sword—it attracts speculative interest but also undermines its reliability as a hedge. Understanding how volatility specifically impacts Bitcoin’s role as a hedging tool, particularly during market downturns, is crucial. If Bitcoin’s volatility can be better managed or predicted, it could become a more reliable component of a diversified portfolio, especially for investors seeking to mitigate risk. This research would significantly enhance the understanding of how Bitcoin can be used in risk management, potentially making it a more attractive option for conservative investors and institutions.

- Safe Haven Properties in Emerging Markets: The study finds that Bitcoin acts as a safe haven primarily in Asian markets. Understanding the market-specific factors that contribute to this role could inform strategies to replicate these properties in other emerging markets. This is particularly important as more regions explore Bitcoin’s potential in their financial systems. Expanding Bitcoin’s safe haven role beyond Asian markets could increase its global appeal and utility, making it a more universally recognized asset during times of financial stress.

- Regulatory Impact on Bitcoin's Risk Management Role: As regulatory frameworks around Bitcoin continue to evolve, there is a critical need to understand how these changes might impact Bitcoin’s effectiveness as a hedge or safe haven. This research would explore whether increased regulation could stabilize Bitcoin’s market behavior, making it a more predictable and reliable tool for risk management. Clearer regulatory guidelines could enhance Bitcoin’s legitimacy and acceptance in traditional finance, potentially leading to broader adoption by institutional investors.

- Time Horizon Sensitivity in Risk Management: The study shows that Bitcoin’s risk management properties vary significantly depending on the time horizon. Researching the factors that drive these differences would help investors optimize their use of Bitcoin across various timeframes. This could include exploring whether certain strategies or portfolio allocations are more effective over daily versus weekly horizons. This knowledge would allow for more tailored investment strategies, enabling investors to better align their use of Bitcoin with their specific risk management goals and timelines.

- Enhancing Bitcoin's Liquidity for Risk Management: Liquidity concerns remain a significant barrier to Bitcoin’s broader adoption as a hedge or safe haven. Researching mechanisms to improve Bitcoin’s liquidity, such as through financial derivatives or institutional investment vehicles, could make it a more reliable and accessible option for risk management. Improved liquidity would reduce the transaction costs and risks associated with using Bitcoin as a hedge or safe haven, making it a more attractive option for a broader range of investors.

(2) Briefing Note Material

Descriptive Title

Evaluating Bitcoin’s Role as a Diversifier, Hedge, and Safe Haven in Financial Markets

Summary

Bitcoin’s role in financial portfolios is multifaceted, serving primarily as an effective diversifier with some potential as a hedge and safe haven. The study demonstrates that Bitcoin can reduce portfolio risk through its low correlation with traditional assets, making it a valuable tool for diversification. However, its capacity to hedge against market downturns or serve as a safe haven during crises is limited and varies significantly across different time horizons and market conditions.

While Bitcoin offers diversification benefits, its high volatility, speculative nature, and liquidity concerns may undermine its reliability as a hedge or safe haven. As the regulatory landscape evolves and Bitcoin becomes more integrated into mainstream finance, its role in risk management may become more defined, offering clearer opportunities for its use in diversified investment strategies.

Overview

Bitcoin, as a digital asset, has gained considerable attention for its potential role in risk management, particularly as a diversifier, hedge, and safe haven against various financial assets such as stocks, bonds, commodities, and currencies. This study examines Bitcoin's performance in these roles by analyzing daily and weekly data from July 2011 to December 2015 using a Dynamic Conditional Correlation (DCC) model. The analysis reveals that while Bitcoin consistently acts as an effective diversifier across a range of assets, its capacity as a hedge and safe haven is more limited and varies significantly depending on the time horizon and specific market conditions.

The daily data analysis indicates that Bitcoin does not serve as a strong safe haven for most assets studied but does act as a strong hedge against Japanese and Asia Pacific stocks. Bitcoin's ability to serve as a safe haven is more evident in weekly data, particularly in the context of Chinese and Asia Pacific markets. These findings suggest that Bitcoin's risk management properties are highly sensitive to the time horizon and market conditions, with stronger hedging and safe haven effects observed over longer periods.

The study also highlights the challenges associated with Bitcoin's high volatility, speculative nature, and liquidity concerns, which may undermine its reliability as a hedge or safe haven. Despite these limitations, Bitcoin's role as a diversifier remains robust, offering valuable risk reduction benefits when included in diversified portfolios. The evolving regulatory landscape and increasing acceptance of Bitcoin as a mainstream asset could further influence its role in financial markets.

Stakeholder Perspectives

- Investors: Institutional and retail investors are likely to view Bitcoin as a valuable diversifier in their portfolios, particularly due to its low correlation with traditional assets. However, they may approach its use as a hedge or safe haven with caution, given its high volatility and varying effectiveness across different time horizons.

- Policymakers: Regulatory bodies may be interested in how Bitcoin's role in risk management evolves as regulations around cryptocurrencies become more defined. They may also consider the implications of Bitcoin’s potential to disrupt traditional financial systems, especially during periods of market stress.

- Financial Institutions: Banks and investment firms may explore Bitcoin's inclusion in diversified investment products but will need to carefully assess its risk management properties, particularly in the context of hedging and safe haven roles.

Key Assertions

- Bitcoin as a Diversifier: Bitcoin consistently serves as an effective diversifier across a broad range of financial assets. Its low correlation with traditional assets, such as stocks and bonds, makes it a valuable addition to diversified portfolios, helping to reduce overall portfolio risk.

- Hedging Properties of Bitcoin: Bitcoin's role as a hedge is limited and highly context-dependent. It acts as a strong hedge against Japanese and Asia Pacific stocks in daily data but shows more pronounced hedging properties against Chinese stocks in weekly data. These variations highlight the need for investors to carefully consider time horizons when using Bitcoin for hedging purposes.

- Bitcoin as a Safe Haven: Bitcoin exhibits safe haven properties primarily in the context of extreme market downturns in Chinese and Asia Pacific markets, particularly over weekly periods. Its role as a safe haven is less reliable in daily data, suggesting that its effectiveness as a refuge during crises may be contingent on the duration of the market stress.

(3) Implications for Bitcoin

Implications for Bitcoin Mining

- Increased Institutional Interest: As Bitcoin gains recognition as a diversifier in financial portfolios, there may be increased demand from institutional investors. This could lead to greater interest in Bitcoin mining, especially from larger entities looking to secure a steady supply of Bitcoin. Increased mining activity could potentially lead to further centralization of mining operations, as only well-capitalized firms might be able to sustain the high costs associated with competitive mining.

- Impact on Network Security: Higher demand for Bitcoin as a financial asset could increase the security of the Bitcoin network by attracting more miners. More miners would contribute to a higher hash rate, making the network more resistant to attacks. However, if mining becomes more centralized, it could pose risks to the network's decentralization, which is a core principle of Bitcoin’s security model.

Implications for Bitcoin Adoption

- Adoption as a Financial Asset: The study’s findings suggest that Bitcoin is increasingly seen as a viable financial asset, particularly for diversification. This perception could drive broader adoption among institutional investors, asset managers, and even governments looking to diversify their reserves. As Bitcoin is integrated into more investment products, its adoption could expand beyond speculative use to being a staple in diversified portfolios.

- Regulatory Influence: As Bitcoin's role as a hedge or safe haven is explored, regulatory frameworks may become more supportive of Bitcoin adoption. Governments and regulatory bodies might be more inclined to establish clear guidelines and regulations that foster the adoption of Bitcoin in traditional financial markets. This regulatory clarity could reduce uncertainty and promote more widespread adoption across various sectors.

Implications for Bitcoin Use

- Use as a Risk Management Tool: The findings suggest that Bitcoin can play a role in risk management, particularly as a diversifier and, to a lesser extent, as a hedge or safe haven. This could lead to more sophisticated financial products that incorporate Bitcoin, such as Bitcoin-backed bonds, ETFs, or other derivatives. As these products become more common, Bitcoin could be used more strategically in managing financial risks across a wide range of portfolios.

- Shift in Perception Among Users: For individual users, the perception of Bitcoin may shift from being primarily a speculative asset to a more stable financial instrument with defined risk management roles. This could encourage more long-term holding and strategic use of Bitcoin, rather than short-term trading. Additionally, as Bitcoin's role as a safe haven becomes more recognized, especially in regions like Asia, users in other parts of the world may begin to adopt it for similar purposes during periods of economic uncertainty.

Broader Economic Implications

- Influence on Global Financial Systems: As Bitcoin is increasingly adopted as a diversifier and potentially as a hedge or safe haven, its influence on global financial systems could grow. This could lead to a reconfiguration of how global portfolios are structured, with Bitcoin playing a central role in mitigating risks associated with traditional financial assets. In turn, this could challenge existing monetary policies and financial stability frameworks, particularly if Bitcoin becomes a significant component of national reserves.

- Potential for Financial Inclusion: Bitcoin’s increasing role as a financial asset could also contribute to financial inclusion, particularly in regions with unstable currencies or limited access to traditional banking services. As more people and institutions adopt Bitcoin, it could provide an alternative means of preserving wealth and conducting transactions, thereby offering a financial lifeline in economically distressed regions.

Comments ()