Update - Bitcoin pricing framework / model published!

I'm happy to announce that our new journal article, "A supply and demand framework for Bitcoin price forecasting," was published today and is now available for free download from the Journal of Risk and Financial Management. Click on the link below:

A Supply and Demand Framework for Bitcoin Price Forecasting

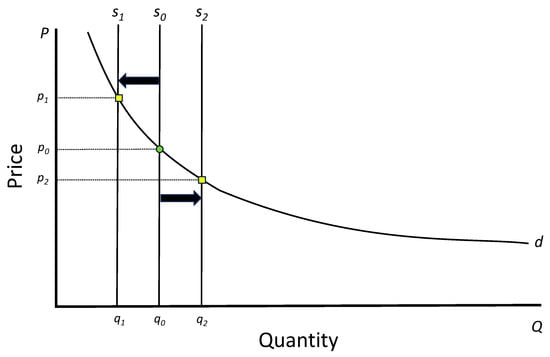

We develop a flexible supply and demand equilibrium framework that can be used to develop pricing models to forecast Bitcoin’s price trajectory based on its fixed, inelastic supply and evolving demand dynamics. This approach integrates Bitcoin’s unique monetary attributes with demand drivers such as institutional adoption and long-term holding patterns. Using the April 2024 halving as a baseline, we explore model scenarios with varying assumptions about growth in adoption and supply-side constraints, calibrated to real-world data. Our findings indicate that institutional and sovereign accumulation can significantly influence price trajectories, with increasing demand intensifying the impact of Bitcoin’s constrained liquidity. Forecasts suggest that modest withdrawals from liquid supply to strategic reserves could lead to substantial price appreciation over the medium term, while higher withdrawal levels may induce volatility due to supply scarcity. These results highlight Bitcoin’s potential as a long-term investment and underline the importance of integrating economic fundamentals into forward-looking portfolio strategies. Our framework provides flexibility for testing different market scenarios, demand curve functional forms, and parameterizations, offering a tool for investors and policymakers considering Bitcoin’s role as a strategic asset. By advancing a fundamentals-based approach, this study contributes to the broader understanding of how Bitcoin’s supply–demand dynamics influence market behavior.

Over the next while, I will post a few examples of the types of questions that can be addressed with the framework. For instance:

- How does varying the level of current liquid supply impact the timing of a Bitcoin supply shock and on price appreciation?

- What does the current 'constant elasticity of substitution' (CES) model say about Bitcoin price targets if Bitcoin total value matches that of gold?

- How do price trajectory forecasts differ if other demand curves are used, compared to CES?

I am open to specific requests so if after reading the article you have a suggestion for a particular analysis, let me know in the comments.

Comments ()